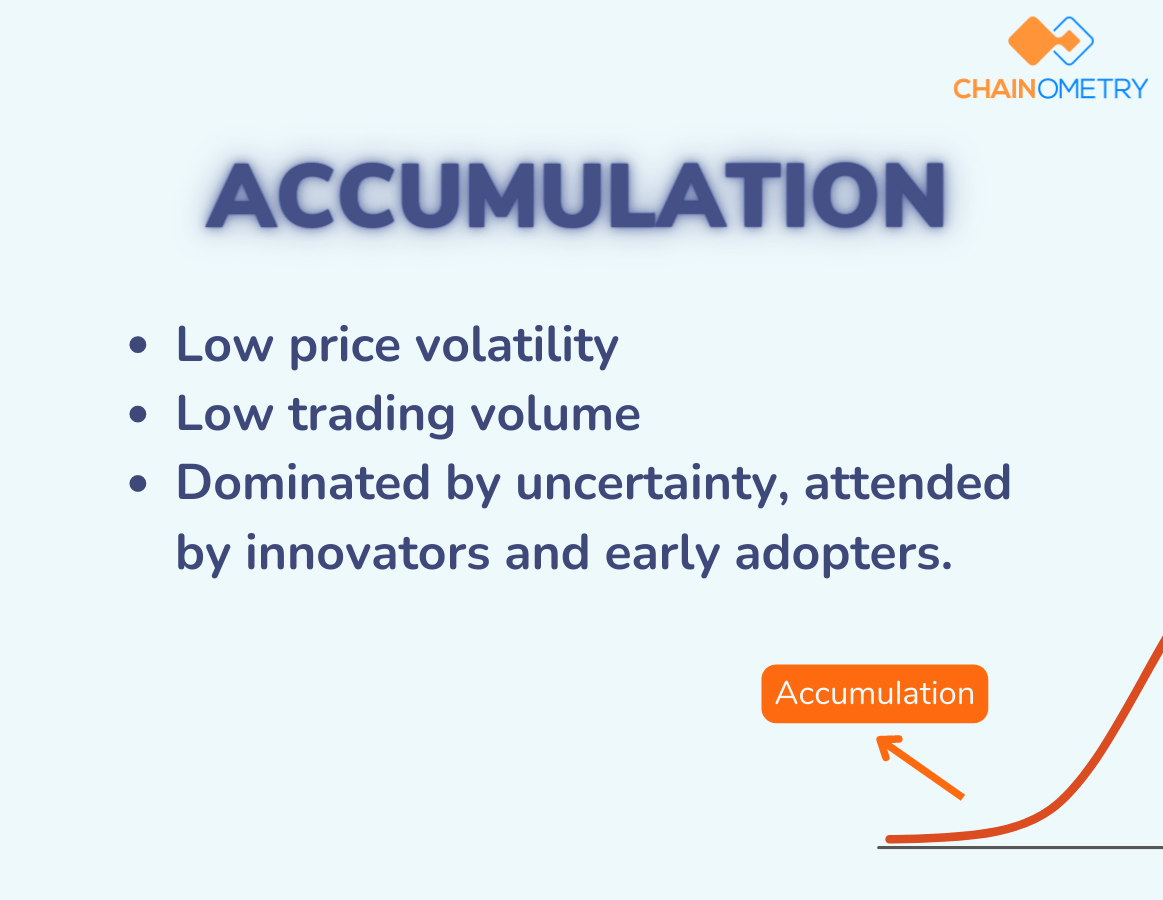

1. THE SLOW ‘ACCUMULATION’

The first phase of a market cycle is accumulation.

It starts after the previous cycle ends, indicated by stabilizing prices, denoting a beginning of a new cycle.

At this phase, the 'innovators' and 'early adopters are the ones who begin to buy, while the overall interest in the market remains low.

Some market participants would see the accumulation phase as an uncertain time to enter the market because it’s difficult to infer if the crypto’s value will trend down.

Hence, the market volume is typically lower than average.

This phase usually attracts long-term holders who are looking to buy and hold for quite a long time because they’re optimistic that there will be a start of a lucrative bull market.

But, short-term traders would need to have patience because this phase could last unpredictably – from weeks to months or even years.

Characteristics of the accumulation phase:

- Low price volatility.

- Low trading volume.

- Dominated by uncertainty, thus attended by innovators and early adopters.