The only all-in-one

crypto accounting software you need.

Are you looking for an accurate accounting report for crypto tax obligations or evaluating trading

performance?

But you’re overwhelmed with myriads of transactions and must work your way

through

complicated calculations? Don’t worry, CHAINOMETRY has got your back.

Crypto tax report software

Exchange, Blockchain, & Smart Contract Support

Performance Analytics

Unparalleled accuracy

Support 190+ countries

Easy & Accurate Import

Ease of direct import.

You just need to connect your accounts via API or upload a CSV file. CHAINOMETRY will automatically check if all your data has been imported correctly

There's no duplication.

CHAINOMETRY automatically eliminates duplicate transactions. You’ll view complete records with no duplicated transactions

Flexibility of manual entry.

Aside from automatic import, you can also choose to add transactions manually with error-minimizing data entry control from CHAINOMETRY.

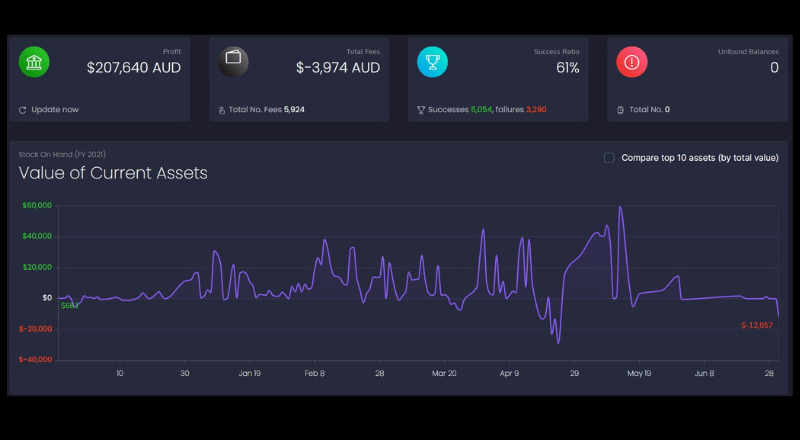

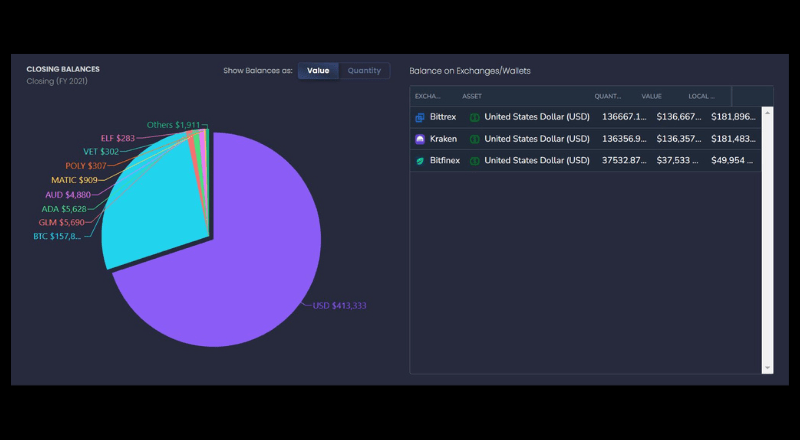

POWERFUL ANALYTICS & PORTFOLIO TRACKING

More than just a typical portfolio tracking dashboard. View insights of your total holdings, ROI, and growth over time

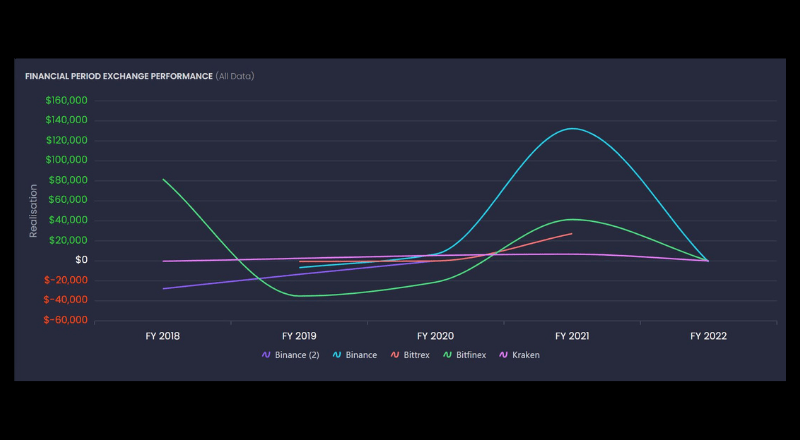

Measure your success on trading performance Insightful chart showing realized profit and loss over time

Monitoring and comparing asset value against top assets. You can also compare to traditional assets like Nasdaq and Gold.

Keep track of personal balance across various exchanges and wallets

Understanding trading performance across different trading accounts & different financial years

COINS, NFT & DEFI SUPPORT

-

Track gains and losses on NFTs in your CHAINOMETRY portfolio

-

Automatic import of all trades and liquidity transactions from various DeFi block chains, like Ethereum, Solana, and Cardano. DeFi platforms, like Uniswap, Sushiswap, Cream, Value, Balancer, and many more are also supported

-

Staking and rewards summary. View your rewards based on the amount you have staked

-

Detailed accounting and tax report on crypto coins, NFT, and DeFi investments

Precise Calculation & Error Reconciliation

-

Detailed breakdown of income, acquisition costs, long/short-term gains for each NFT and crypto assets

-

Double-entry ledger system. CHAINOMETRY makes sure that every change in your asset balance is backed by an entry, hence issues can be easily detected. After all, accounting is all about making everything in balance, right?

-

Minute-to-minute price lookups as a basis for accuracy to allow a non-misleading report production, precise calculation, and accountable analytics

-

Highlights of missing transactions. Any errors due to incorrect importing or missing transactions are highlighted to say goodbye to absurd gains and inaccurate reports

Reliable International Tax Reports

-

The best solution for wherever you come from. CHAINOMETRY supports USA, Canada, UK, Australia, and many more countries with all of the respective currencies

-

Wide options of cost basis methods. CHAINOMETRY supports FIFO, LIFO, HIFO, LOFO, ACB, Share Pooling, or you can let us know about your country’s preferred cost basis method

-

Powerful transaction analysis in any local currency. View a detailed analysis of your transactions in your chosen currency.

-

One-click download. Easily download your comprehensive tax report in PDF format

Dependable Service Support

Helpful Resources.

With our Help Center and handy guiding resources built upon your feedback, we make sure that crypto taxing is simple.

Contact us

Are you an accountant?

Contact us for tailored features and special pricing for accountants

Accountant HubA Perfect Plan for Everyone

Best price in the market

You’ll see that we offer the most worth-it plans. Unlike others, you can add data from 5 years of transactions and produce tax reports for all those years within a single plan.

Buy more, save more.

A pro trader? You can buy additional transactions at a lesser cost as we employ a special algorithm that ensures you get the most value from us.

The only crypto tax software you need in life.

With the non-ending list of useful features we’ve mentioned, there’s nothing to worry about. Try now!

True calculator: 10,000 Free Transactions & Cost Analysis!

We're the real crypto tax calculator. Unlike other claim-to-be calculators, we genuinely give you free access to detailed cost analysis of your first 10,000 transactions