1. You‘ll save a great deal of money, at least $198

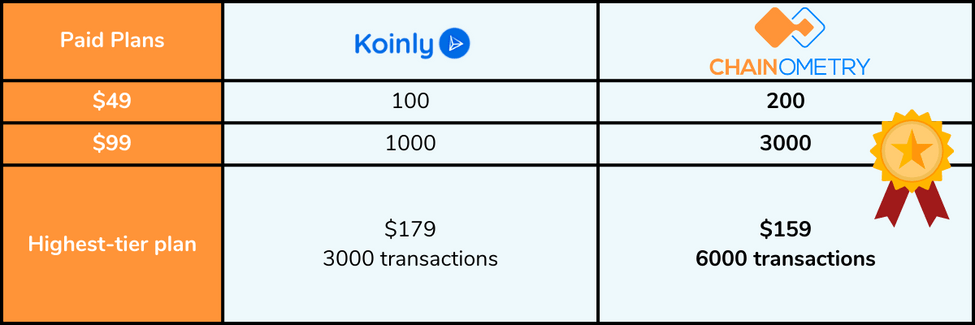

Let’s compare the pricing plans, using the US Dollar.

CHAINOMETRY offers a free plan (Turtle),

all inclusive. with a limit of 50 transactions on your tax reports.

You can still download up to 10,000 transactions and see profit and loss details for all these transactions

as well as see analytics for all 10,000 transactions. At the time

of writing Koinly does not offer an all inclusive free plan so if you have up to 50 transactions then you're ahead $49!

As of the date of writing, the lowest paid plan of Koinly is $49, limiting transactions up to 100 only. With similar features,

CHAINOMETRY’s $49 plan brings much greater value as it supports 200 transactions.

The next level of the paid plan of Koinly is priced at $99 which limits up to 1,000 transactions only. With the same price,

CHAINOMETRY gives you amazing flexibility of 3,000 transactions.

For you who trade more often, you’ll benefit much more from CHAINOMETRY’s $159 plan that supports 6,000+ transactions,

rather than Koinly’s more expensive $179 plan that only supports 3,000 transactions.

But, there’s much more you can get from CHAINOMETRY aside from just a greater number of transactions.

You can save huge money — at least $198.

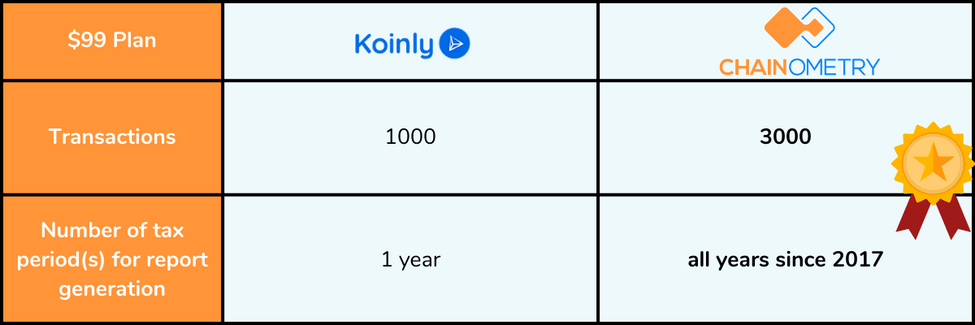

Let’s take an example of Koinly’s $99 “HOLDER”. plan vs. CHAINOMETRY’s $99 “BULL”. plan.

To generate a report, Koinly only allows you to choose a single tax year.

If you have 1000 transactions per year, but you want to produce reports for three tax years, then you have to pay $99*3 periods = $297 in total.

But with CHAINOMETRY, you only need to pay $99 (3000 transactions) to generate an unlimited number of reports for different tax periods.

You’ll be saving $198.

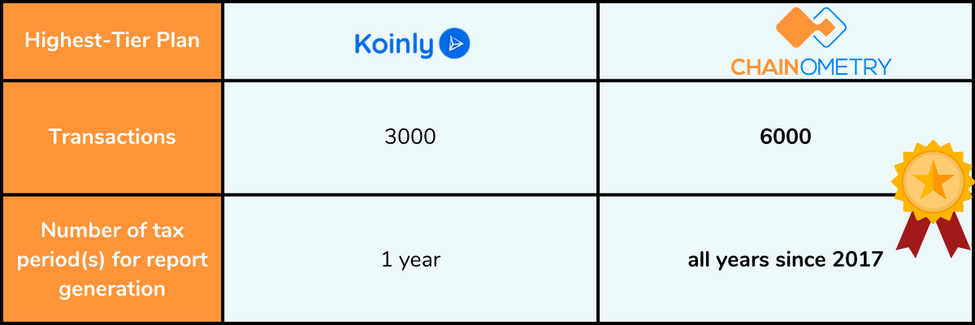

Let’s take another example, now using Koinly’s $179 plan vs. CHAINOMETRY’s $159 plan.

Considering that you’re pro traders who need to generate many reports for various tax periods, you have to pay $179 to Koinly to generate a single tax-year report, only for 3000 transactions.

So, if you have to generate 2-year tax reports (assuming you have 3000 transactions per year), you have to pay $179 x 2 = $358.

And let's face it, how often do you transactions fit neatly into a single financial period? Chances are, you're gonna need at least two years.