Let's explain with an example

22-NOV-2021: BUY 1 Bitcoin (BTC) @ unit price of $57,000 USD

(Outlay =$57,000)

29-NOV-2021: BUY 1.5 Bitcoin (BTC) @ unit price of $42,000 USD (you bought the dip!)

(Outlay = $63,000)

13-JUN-2022: TRADE 0.5 Bitcoin (BTC) for 10 Ethereum (ETH) @ unit price of 0.05 BTC

(Outlay = 0.5 BTC)

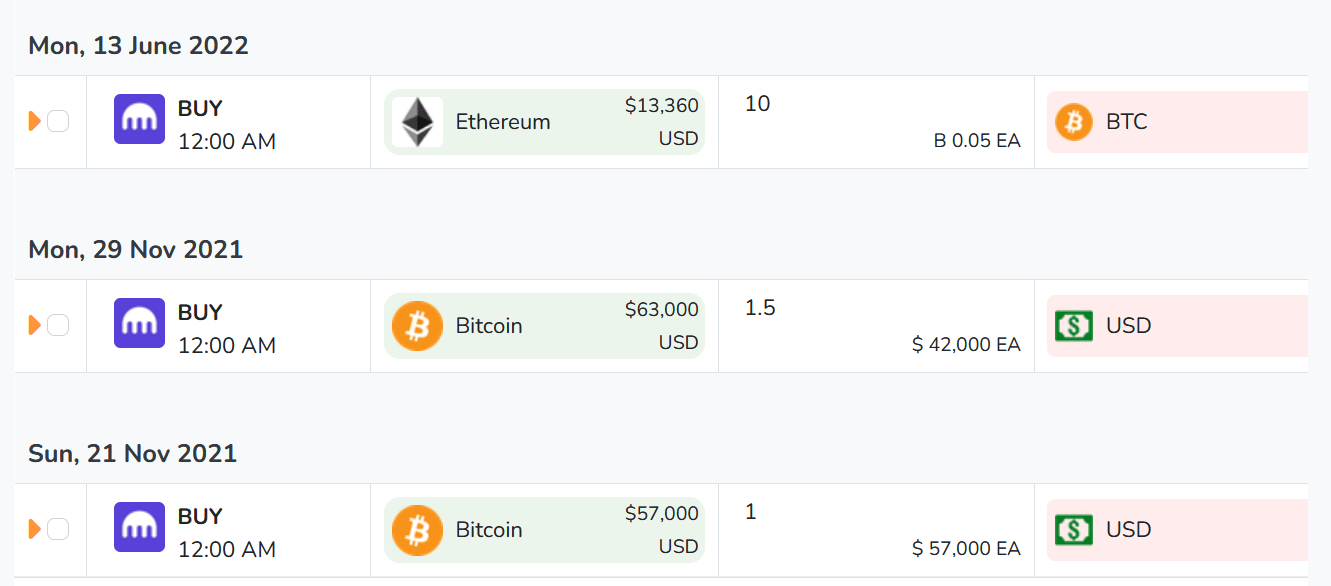

This is how the transactions look in CHAINOMETRY

Notice that the transaction on the 13th is listed as a buy, you are acquiring Ethereum with your Bitcoin which is used as the currency in that transaction.

Your total outlay

CHAINOMETRY uses a base currency for all your transactions in an account that is most

appropriate to the exchange (Kraken), in this case USD.

In order to determine your total outlay of all your acquisitions of Bitcoin, CHAINOMETRY

uses the base currency to standardise the cost basis for all your purchases. We see that your total outlay

for the purchases on the 21st and 29th is $57,000 + $63,000 adding up to $120,000 for 2.5 Bitcoin.

1.0 @ $57,000 USD Each

1.5 @ $42,000 USD Each

------------------------

2.5 @ $120,000 USD = Cost Basis

----------------------------------

TOTAL $120,000 USD / 2.5 = $48,000 (Unit Price)

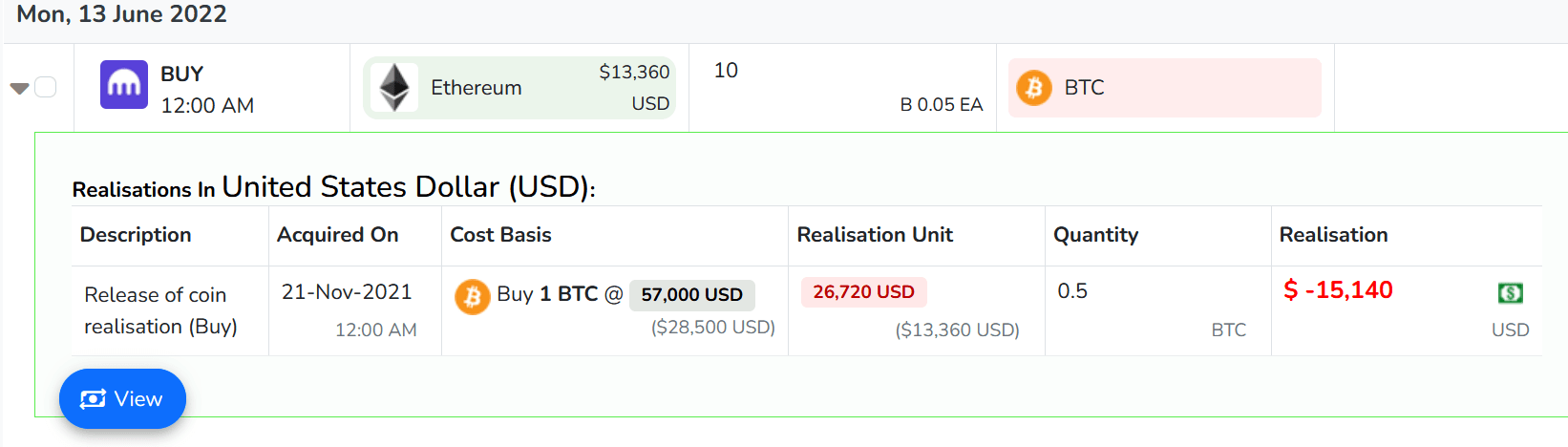

Your first problem is that you no longer have 2.5 Bitcoin because you traded 0.5 of that for Ethereum.

CHAINOMETRY records this as a release of asset and a realisation is born. The price

of a Bitcoin at the time of release was $26,720 and using the First-In-First-Out inventory valuation method

the cost basis for this transaction (acquired on 21st November @ a unit price of $57,000) is $28,500. So you made

quite a loss and that is recorded as such ($15,140).

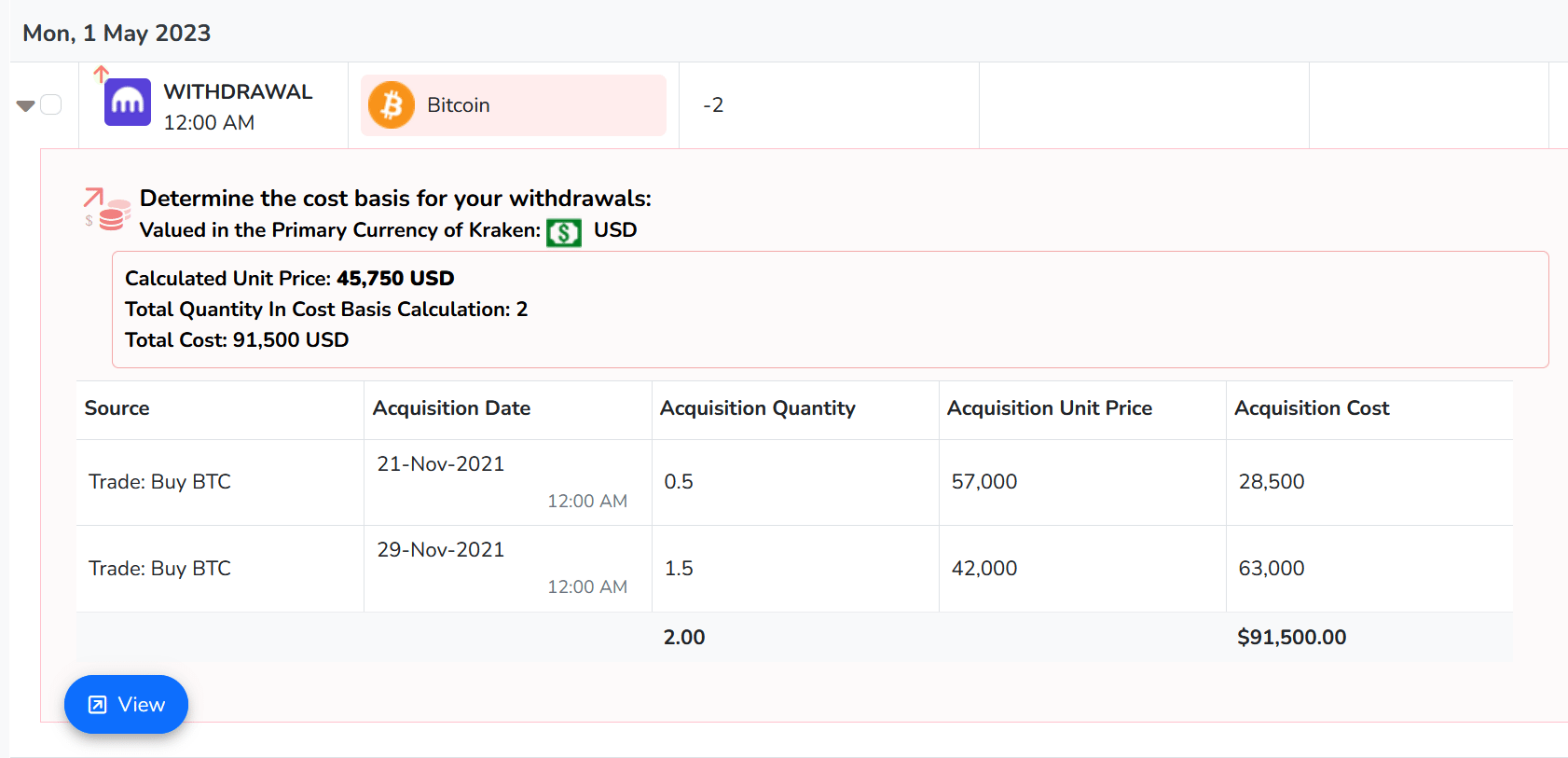

You now have 2 Bitcoin after buying 10 Ethereum but how do you work out your cost basis for the Bitcoin you have left?

And why do we even care in the first place?

Why we need to value your withdrawals

You don't necessarily need to care about the cost basis for your coins if you keep them on the exchange and eventually sell them there.

Most crypto tax calculators are able to calculate the correct cost basis in this situation. You do need to worry about it if you move your money

out of the exchange.

Moving your Coins Out of the Exchange - The Withdrawal

When you withdrawal your coins from one Exchange account or Wallet into another one you need to know the cost basis

for each coin so that when you eventually sell that coin a profit or loss can be determined.

So going back to our simple example, how do we do this manually?

We need to remove the 0.5 Bitcoin at the correct cost basis and then recalculate:

1.0 @ $57,000 USD Each

1.5 @ $42,000 USD Each

-0.5 @ $57,000 USD Each

------------------------

2.0 @ $91,500 USD = Cost Basis

----------------------------------

TOTAL $91,500 USD / 2.0 = $45,750 (Unit Price)

You now have your cost basis for all your remaining Bitcoin including the Ethereum purchase. This is a tedious process.

Even writing this blog and doing all the calculations manually (I did it as an additional test and confirmation of the output)

bored me to the proverbial tears. Can you image how difficult it would be if you had many coins with many purchases and transfers?

CHAINOMETRY Does All This For You

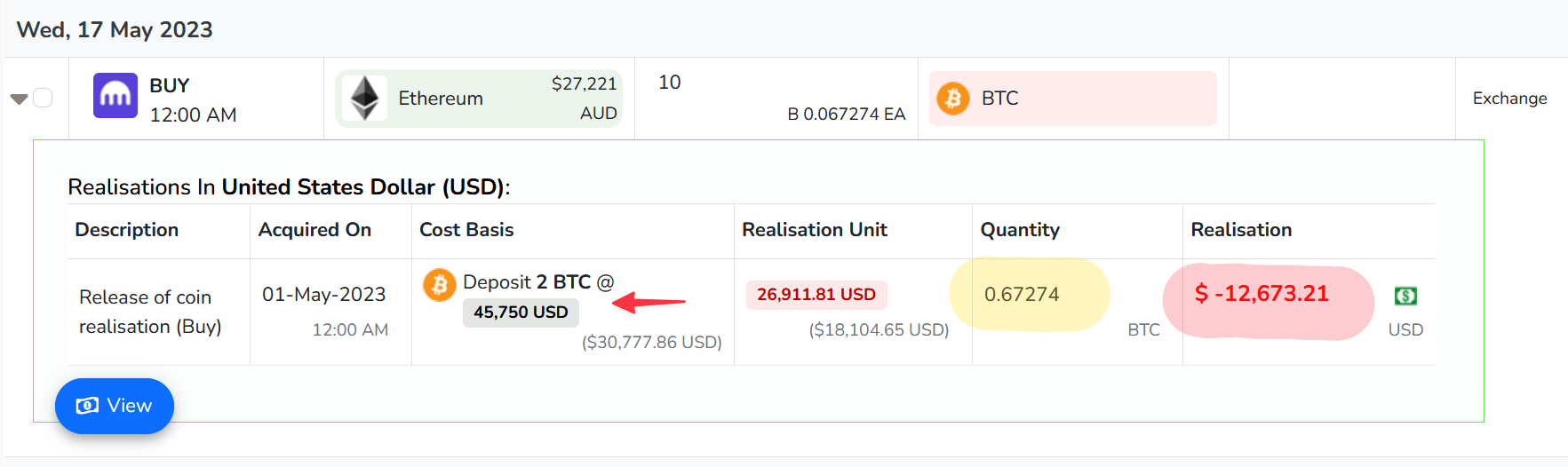

If you're as bored as I am in figuring all this out, then CHAINOMETRY is here to help. Have a look at the image

below and you will see that all this is calculated for you, including all the transactions that make up the final unit cost

price so you can verify the end result. So now you have the cost basis for the withdrawal, what do you do with it?

This information is your Saviour when it comes to the auditing process. You can verify exactly how your cost basis was calculated.

In the past, to make this cost basis calculation work for you, you had to enter this information into the related deposit but the all new matching algorithm will save you the hastle.

You still have the ability to change this information if you need to; you're always in control, but to find out how this all works, read on.

The Deposit and the all new Matching Algorithm

Moving Your Coins Into The Exchange

You've now moved a bunch of bitcoin from your personal wallet back to the exchange (you've

heard from your favorite youtuber/influencer that there's going to be a huuuuuggge Ethereum pump

and you want to trade some of your Bitcoin for Ethereum).

You go to your wallet and transfer Ether to your exchange. Deposits in CHAINOMETRY

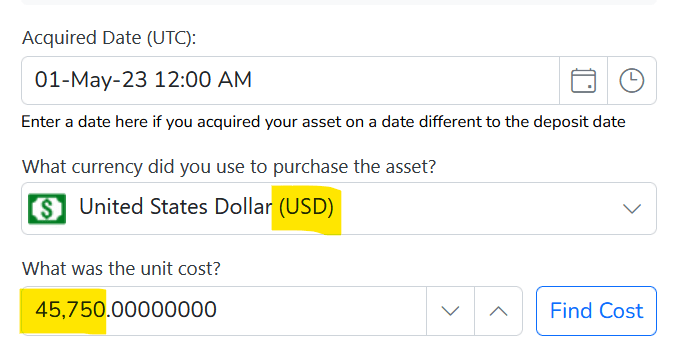

have a special property called 'Acquired Cost' which allows you to specify a basis for the asset your depositing.

The new Matching Algorithm will automatically match the source for this deposit and determine the cost basis based on a previous withdrawal.

This cost basis will automatically be entered into the deposit's Acquired Information using the calculated amount for the withdrawal as mentioned above

(you can opt-out of this automatic process by disabling 'Auto-match' on the deposit).

This brilliant little setting allows you to control the outcome of the transaction when it finally sells or trades on the exchange.

Let's say it was traded for Ethereum like this

Here you've made a purchase of Ethereum with your Bitcoin and therefore some of your bitcoin is 'sold'. Notice how

it used the cost basis entered previously of $45,750 USD and since you've used 0.67274 of your Bitcoin, the total outlay

is $30,777.86 USD for this transaction. The important point here is that CHAINOMETRY used the correct

cost basis and therefore correctly accounted for the loss of $-12,673 USD which will improve your tax position

in this example.

You Are In Control

The above is a simple example of trading a few coins and moving them from one place to another.

As simple as it sounds the correct bookkeeping for these transactions is quite complex. You can see

various intricacies in the requirement for recording transactions, the correct way to record realisations

as a result of purchases and finally the best method of determining the cost basis for numerous acquisitions

over time.

CHAINOMETRY takes all the pain out of this process by calucating the exact cost basis for every withdrawal

and automatically matching that to a deposit. And, importantly, this is not all 'black box', each step has a verifiable audit trail and you can

always override every value that was calculated for you or stop the automatic matching process if you wish.

You have the power, you are in control.