How to get to the other end of a deep, dark and complicated tunnel.

Tax Compliance

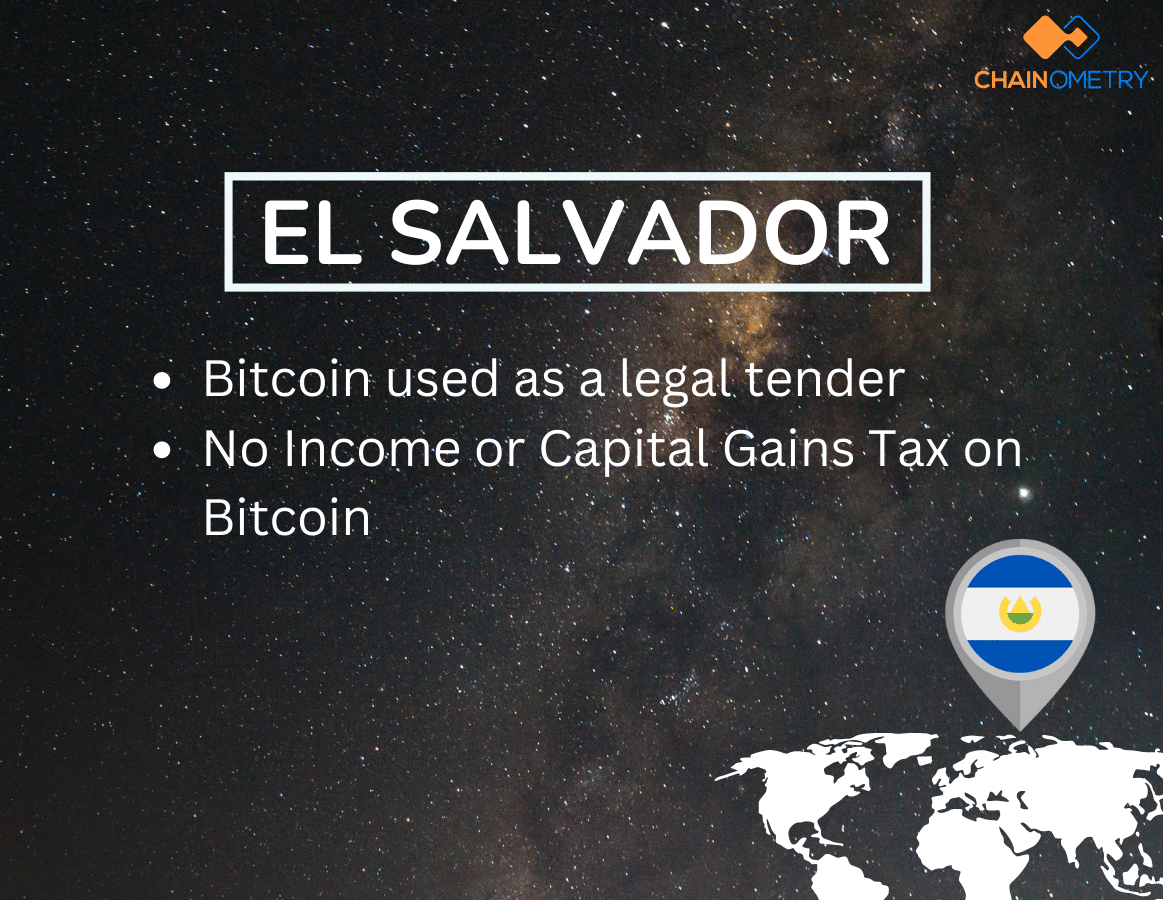

EL SALVADOR

The world knows that El Salvador is the first country in the world that approves Bitcoin as a legal tender, alongside the US dollar.

Good news for all foreign investors: El Salvador does not tax Bitcoin income and capital gains. They do this to draw foreign investment into their economy.

You also need to know that Bitcoins are accepted in business transactions. The 2021 Legislation reinforces that every payee MUST accept bitcoin as payment when offered to them. From buying groceries to buying cars, you can use Bitcoin. The government even made the "Chivo Wallet" app to trade bitcoins for dollars with no transaction fee.

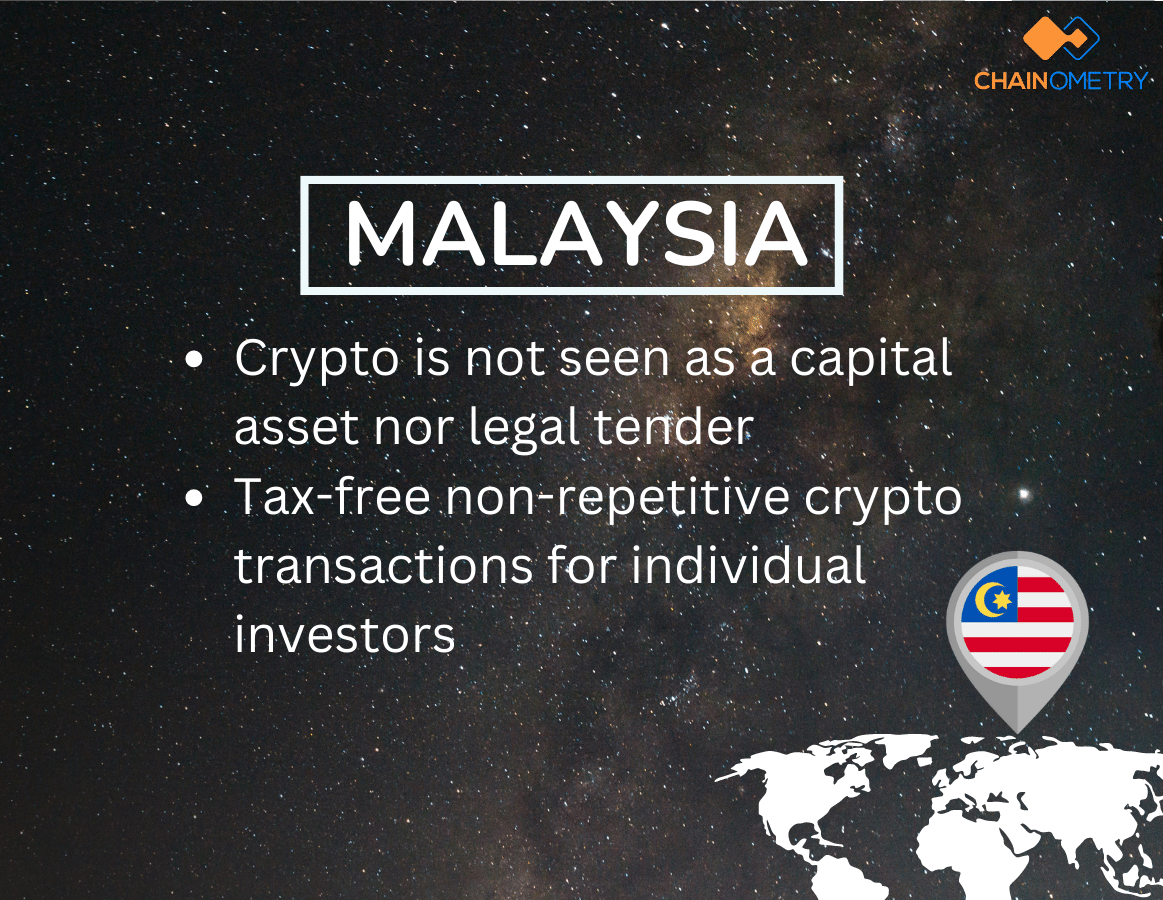

MALAYSIA

Malaysia doesn't treat cryptocurrency as a capital asset nor a legal tender. Crypto transactions are tax-free, given that you're an individual investor and only make crypto transactions occasionally.

If the transactions are repetitive that they're seen as a regular source of income –- just like what a day trader does -- tax will be imposed on your revenue. Malaysia will also impose income tax on any profits generated from crypto for businesses.

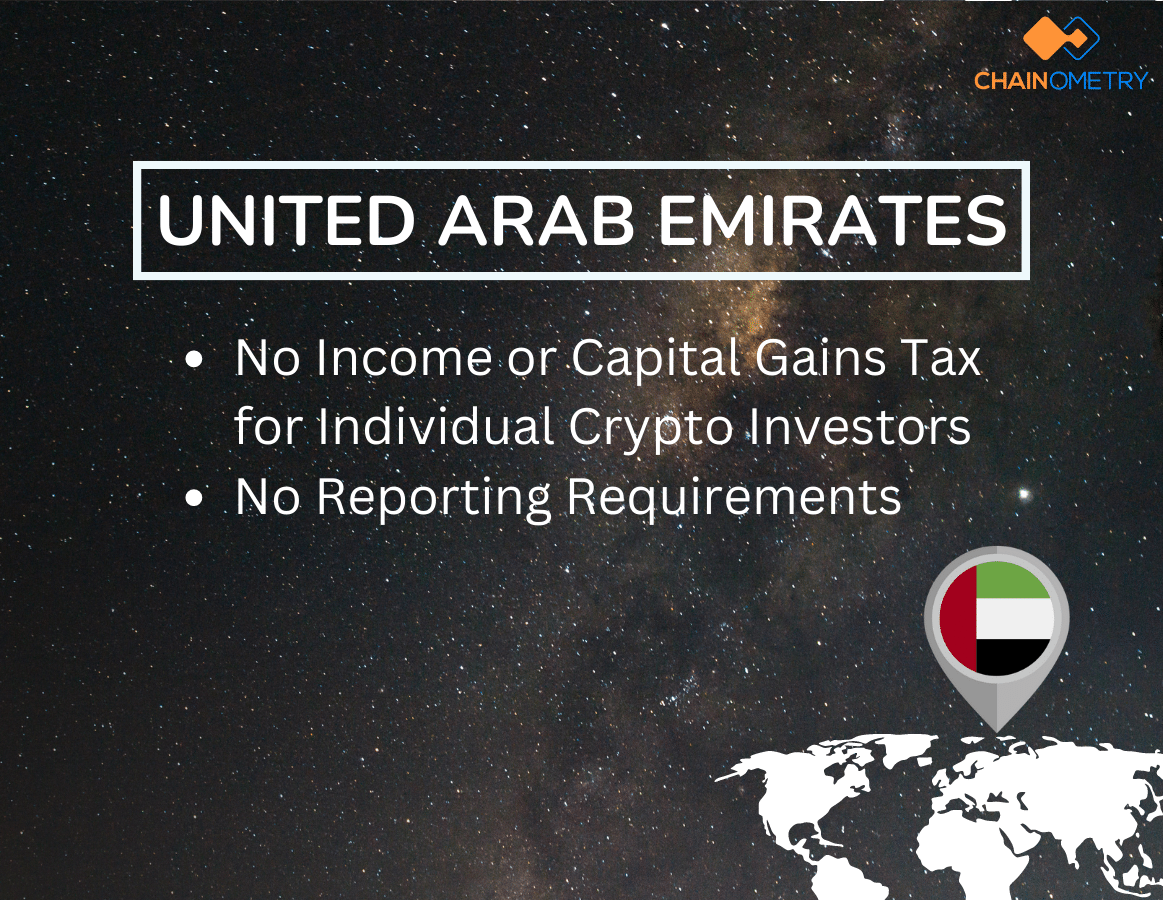

UNITED ARAB EMIRATES

First thing first, note that UAE imposes tax on goods and services purchased with cryptocurrencies through VAT (Value Added Tax).

But, United Arab Emirates doesn't charge Income or Capital Gains Tax for individual crypto investors. There are also no reporting requirements for crypto investors in Dubai.

With the amazing infrastructure and favorable tax system, Dubai truly is attractive for crypto investors. If you are moving to Dubai and becoming a resident there you can benefit lower or no tax compliance requirements.

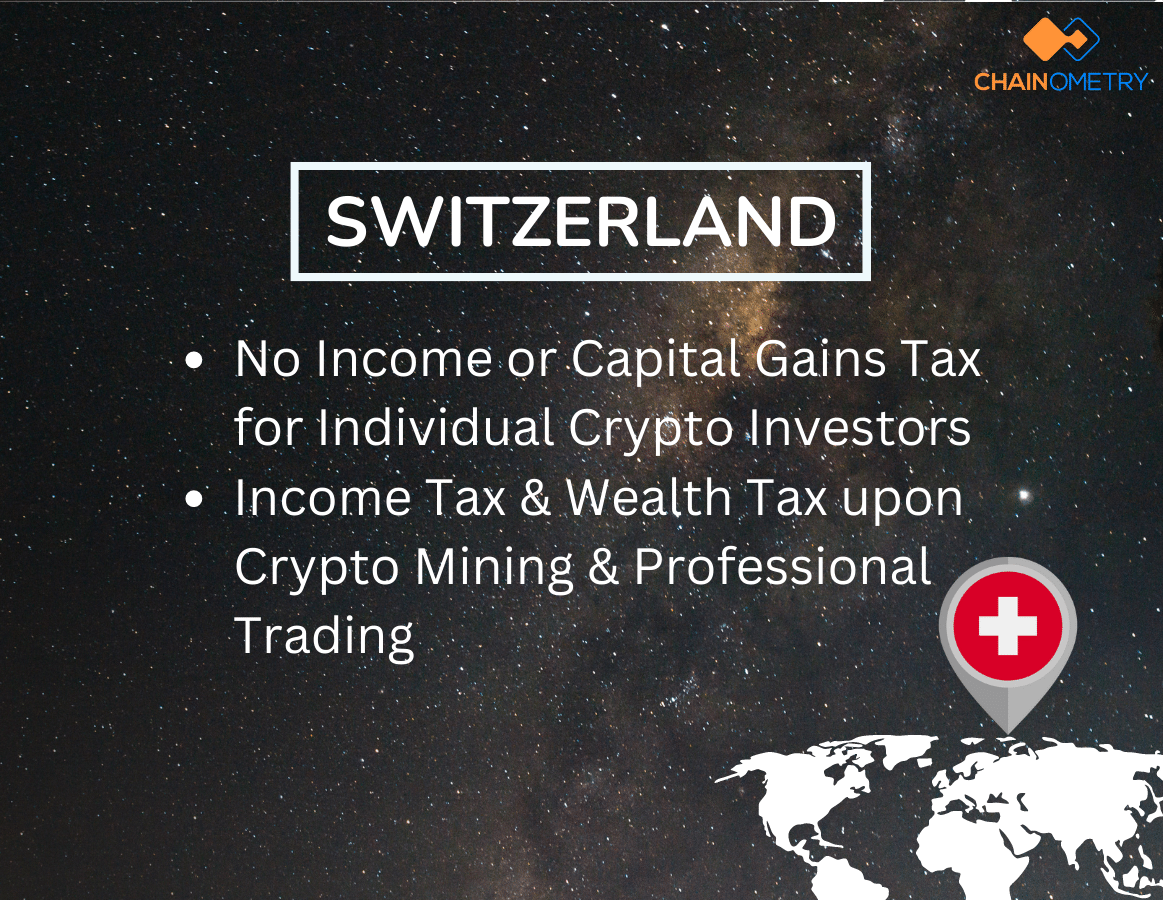

SWITZERLAND

With the nickname 'crypto valley', Switzerland has particular crypto tax laws that can be heard as both good and bad news.

The bad news: Crypto Miner & qualified day traders need to pay Income Tax and Wealth Tax. The Wealth Tax Rate varies from around 0.3 to 0.5 percent, which can also depend on which Canton (member state) you live in.

Good news:

crypto profits coming from individual investors — who don’t trade on a professional level – are exempted from Capital Gains Tax. So it's a great country for beginners and occasional individual investors!

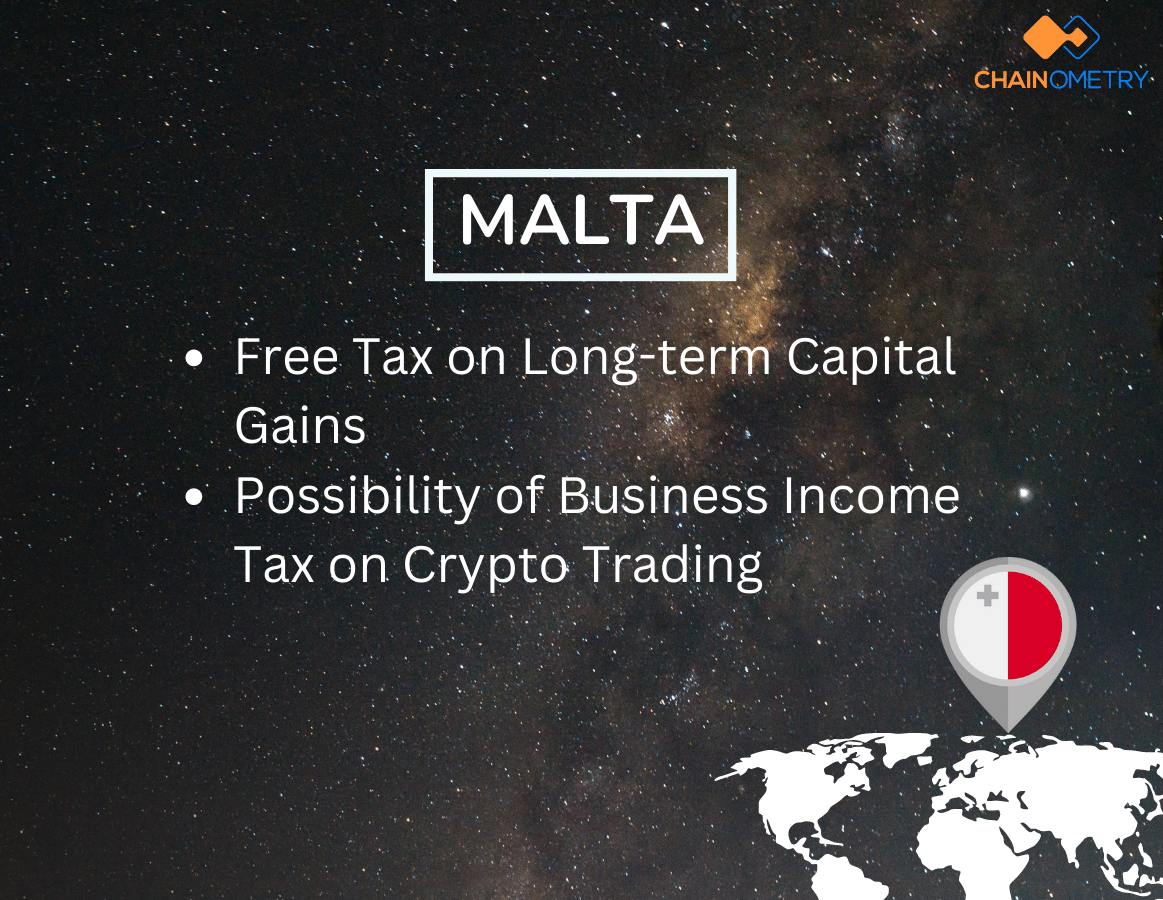

MALTA

Known as 'blockchain island' as it allows crypto as a store of value and exchange medium, Malta will not impose Capital Gains Tax on long-term profit generated from crypto investment. Hence, it really is a crypto tax haven for you who like to hold crypto for a while and sell it at a greater value.

But, note that qualified crypto day traders may be subjected to a business income tax – yet it depends on which bracket you fall in. You may need to pay tax from 0 up to 35%. Just check Maltese Tax Systems to see if there’s a chance for you to pay no tax at all!

Regardless of the country you live in - CHAINOMETRY makes crypto tax simple

Different countries have different tax rules on cryptocurrency.

If you’re living in a crypto-tax-free country, you still need to keep track and evaluate your trading performance using reliable software tools.

If you’re living NOT in tax havens, doing tax with a specific standard can be overwhelming.

But you don’t need to worry! Leave your crypto accounting work to CHAINOMETRY.

CHAINOMETRY simplifies crypto taxes by calculating your profits, losses, income, and expenses — all in a fast, detailed, and reliable way. You just need to sync your crypto wallets and exchanges with CHAINOMETRY via API or CSV file — and we will do the rest.

Your transaction summary and tax reports will be generated based on where you live, in your chosen fiat currency, and with your chosen cost basis method. Click the download report button, and you’d have an insightful report for you or your accountant.

Wherever you live, you can also make better trading decisions by using CHAINOMETRY’s analytical tool. Powered by real-time data processing, you can keep track of your coin balances across multiple wallets & addresses, and also compare your crypto assets’ performance against other investments. You can also monitor your realized profit and loss over time, measure success on trading performance, and understand your trading performance across different trading accounts & different financial years. This is all included free of charge on any plan, including our free plan.

Ready to improve your crypto trading life?