Understand the differences between the two and leverage the opportunities from the core focus you choose.

Tax Compliance

What is “Cost Basis” in Crypto?

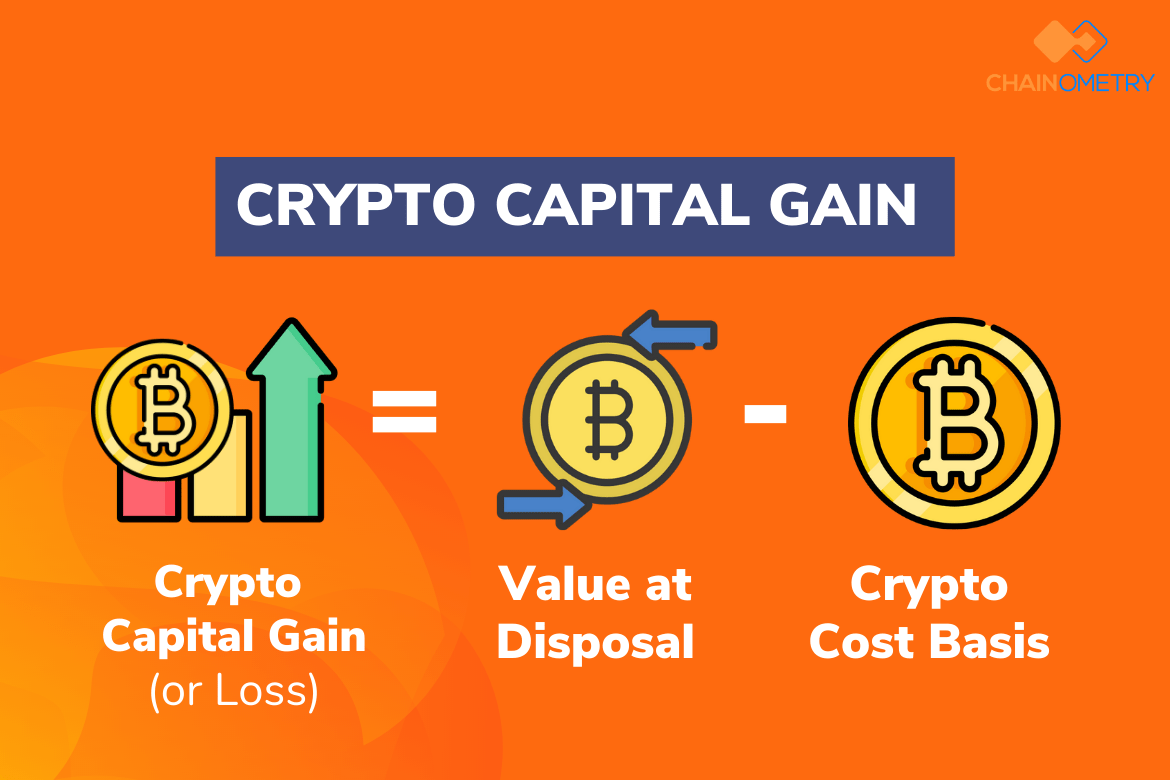

To calculate CGT, you need a cost basis value, i.e. the original value of your crypto asset. Capital gains or losses would be the difference between the selling price of your crypto and its purchase price. If you make a capital gain, you need to fulfill a tax consequence according to your country's pre-determined tax rate.

Put simply, what you paid for acquiring a crypto asset -- including the transaction fee -- is your total cost basis. For example, you bought crypto for $1000 (including $10 in transaction fees). Your total cost basis, in this case, is $1000, even though you only hold $990 worth of crypto after purchasing fees.

A few months later, you sold the crypto for $3000. Your capital gain would be that proceeds, minus your total cost basis. So, $3000 - $1000 = $2000. You will be taxed on your $2000 Capital Gain.

Calculating realisation:

- Crypto Cost Basis = Acquisition Value + Fees (e.g. Brokerage or Stamp Duty Fees).

- Capital Gain (or Loss) = Value at disposal - Crypto Cost Basis.

What happens if I make a capital loss in crypto?

You'll make a capital loss when there's a negative difference between the cost basis value and the sale price of the crypto.

Capital loss needs to be calculated as it can offset a capital gain, hence decreasing the CGT amount you need to pay.

In most cases, if you don't make any capital gains in a financial year, the loss can be carried forward to offset capital gains in future financial years.

What method can I use for determining my crypto cost basis?

Now that you have understood the fundamentals, you might question why there are many cost basis methods when the previous example looks very simple.

Let's see another example when there is more than one transaction.

You bought 1 ETH for $100 in December 2020. In January 2022, you bought 1 ETH for $1,000. This month, you sold 1 ETH for $800.

You made a capital gain of $700 -- which would be subject to Capital Gains Tax --- if you use the first investment (i.e. $100) to calculate your cost basis. But, you suffered a capital loss of $200 if you use the most recent investment (i.e. $1,000) to calculate your cost basis.

Can you see how using a different cost basis method can result in a different impact on your tax bill? Which cost basis method should I use for my crypto investment?

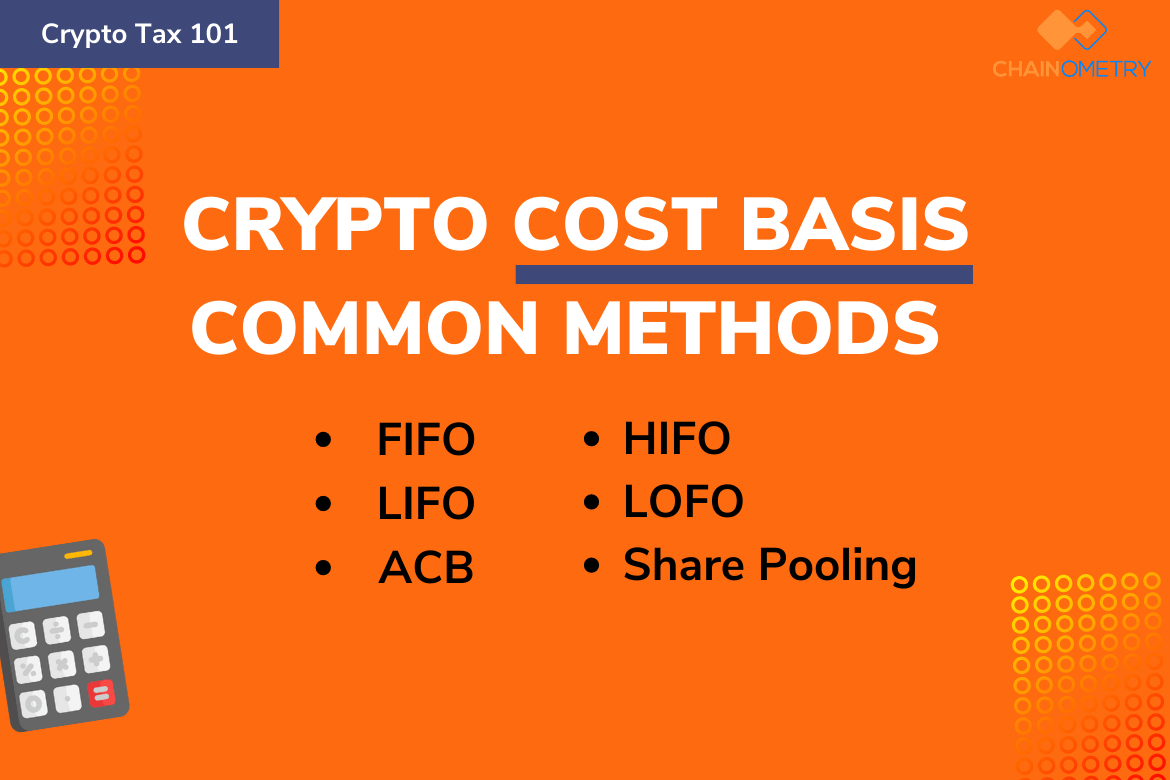

These are the most common cost basis methods for calculating crypto tax:

- TFIFO (First In First Out)

- HIFO (Highest In First Out)

- LIFO (Last In First Out)

- LOFO (Lowest In First Out)

- ACB (Average Cost Basis)

- Share Pooling

FIFO (First In First Out) Crypto Tax Method

FIFO is the most popular cost basis method because it's the most conservative from the accounting perspective. It assumes that the first crypto you acquired is disposed of first.

When the market of a crypto asset is inflationary (i.e. price continues to rise), using FIFO to determine the cost basis can result in a higher capital gain than if LIFO were used — which could mean greater tax to be paid.

Note that FIFO can be beneficial for investors who hold an asset for the long term, as it allows them to obtain long-term CGT discounts – which can result in lower crypto tax compared to when the usual tax rate is imposed.

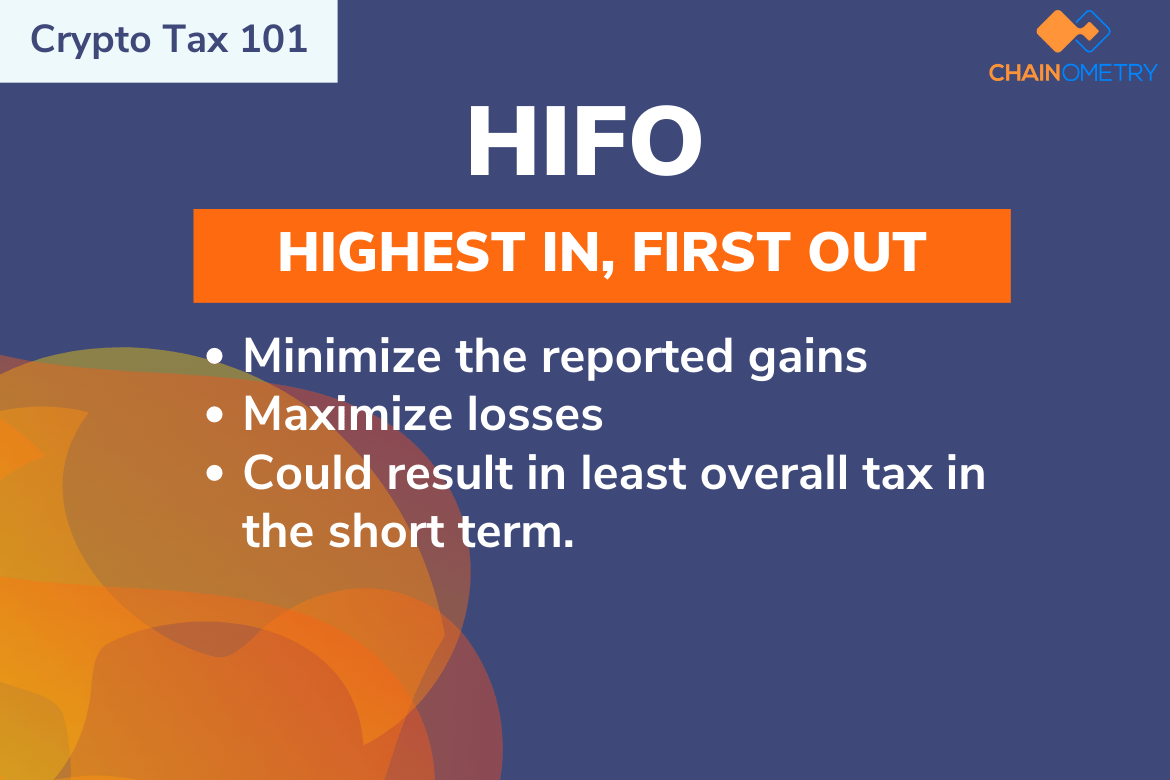

HIFO (Highest In First Out) Crypto Tax Method

Choosing HIFO for your crypto means you would first dispose of the asset with the highest cost basis. The nature of the HIFO method is to minimize the reported gains and maximize losses. In other words, it could result in the least amount of gains, hence the least overall tax in the short term.

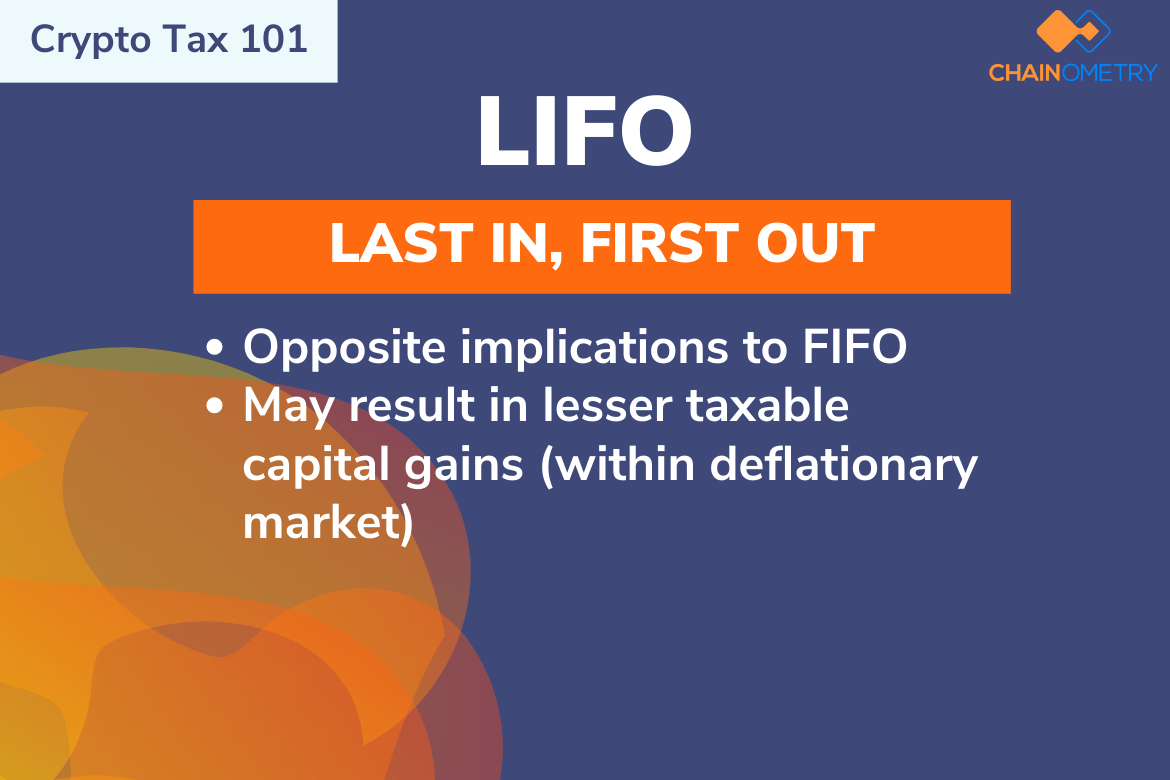

LIFO (Last In First Out) Crypto Tax Method

LIFO is the opposite of FIFO, and so is the implication. LIFO assumes that the last crypto purchased is the first crypto sold.

In some cases whereby the crypto market is volatile that the crypto asset may not appreciate, LIFO method may result in lesser taxable capital gains. However, unlike FIFO, LIFO methods are only permitted in a few countries.

LOFO (Lowest In First Out) Crypto Tax Method

LOFO (Lowest In First Out), or is also known as LCFO (Lowest Cost First Out), will first dispose of the crypto asset with the lowest cost available when calculating your capital gains or losses – in contrast with HIFO.

With this method, your capital gain would more likely be higher than with other methods. But, you may obtain the benefit of discounted long-term CGT rates when it’s applicable.

ACB (Average Cost Basis) Crypto Tax Method

Average cost basis is another straightforward cost basis method as you just need to calculate the average cost for all assets. It is derived by summing up the total acquisition value of your asset (s) and dividing it by the total amount of coins/tokens held.

For example, if you acquired 3 ETH all bought for different amounts, you have to get the total cost by multiplying the unit price by the quantity of each purchase. Once the total price is obtained then you divide the total cost by the total units (in this case: 3 units). You'll have to do this for all the different crypto types in your portfolio.

Share Pooling (for UK Users) Crypto Tax Method

UK's tax authority, HMRC (Her Majesty's Revenue and Customs), requires Share Pool accounting when calculating the cost basis of a coin.

When you sell/dispose of your crypto assets, they will be treated in the following order:

- Same Day Rule: If coins of the same type are acquired and sold on the same day, then all acquisitions are treated as one transaction (i.e. you calculate an average cost basis).

- 30-Day rule: If you re-acquire coins of the same type you have disposed of in the past 30 days, the cost basis of the sold coins will be calculated using the first-in, first-out (FIFO) cost basis method.

- Use the Pooling Rule: This rule can be thought of as the Average Cost Basis, where you need to group each type of token you hold into pools and calculate the average purchase cost of all tokens in the pool.

This crypto tax calculation rule is indeed quite complicated (but you can leave it to CHAINOMETRY as we support the Share Pooling method!) as UK intends to hinder many ‘tax-loss harvesting’ schemes, which in short is when you sell investments deliberately at loss in order to reduce tax liability.

The cost basis method you use could affect how much crypto tax you claim

The cost basis method you choose would depend on your motivation. Whether it is for minimizing tax, holding to the accounting conservatism principle, or due to a specific financial situation and needs.

Most importantly, follow the specific crypto tax reporting guideline from your country. Tax offices around the world have specific requirements on what cost basis method to use for calculating your crypto tax.

Don’t hesitate to contact your tax authorities and inquire them which method to use for calculating capital gain/loss of your crypto.

How to Calculate Crypto Tax Basis with CHAINOMETRY

CHAINOMETRY calculates the cost basis and the resulting gains or losses of your crypto for you, according to your country’s most recommended cost basis method. There's a variety of cost basis methods to choose from based on your country’s requirements, or your specific need if you’re an investor with an opportunity to choose your preferred method.

CHAINOMETRY simplifies your crypto tax needs with the most detailed accounting reports – at the best price.

We also help you make better trading decisions with easy-to-use analytic tools powered by real-time data processing – all included for free.

Try out different Cost Basis methods using CHAINOMETRY to see all of the possible tax implications — for you to choose the one that suits you best (as long as your country’s tax standard allows it).