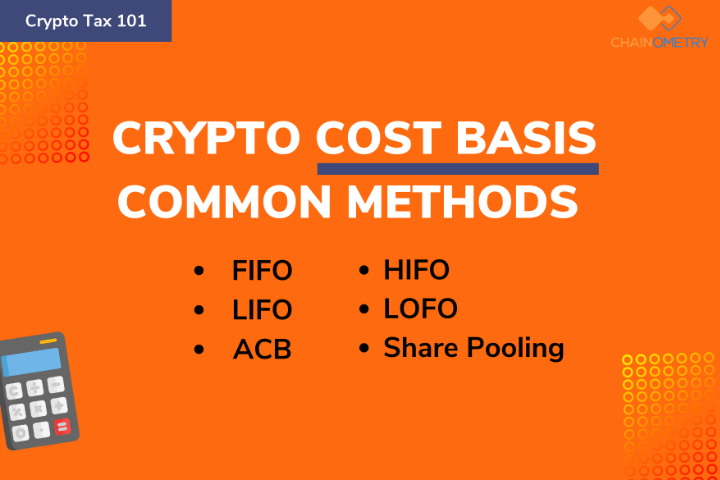

FIFO, HIFO, LIFO, LOFO, ACB & Share Pooling: What cost basis method should I use for calculating crypto tax?

Trading

Investing

Crypto Investing

Investing refers to buying an asset with the aim of gaining profit through an increase in its value over the medium or long term.

Crypto investors try to build wealth through gradual appreciation over a long time horizon rather than short-term gains. They can reduce their risk through diversification, i.e. possessing a mix of investments. For example, rather than 'HODLING' a bitcoin only, they can also invest in Dogecoin, Ethereum, Ripple, Cardano, etc.

In the crypto market, investors would usually undertake a fundamental analysis, which would refer to taking a deep dive into all the information available about a crypto project to analyze its prospect. It’s about doing your research to understand the background and talent of the development team.

As such, when investors believe that particular crypto has a great intrinsic value, they would patiently hold onto the coin regardless of the market sentiment, believing that a markup phase in the crypto market cycle is coming sooner or later.

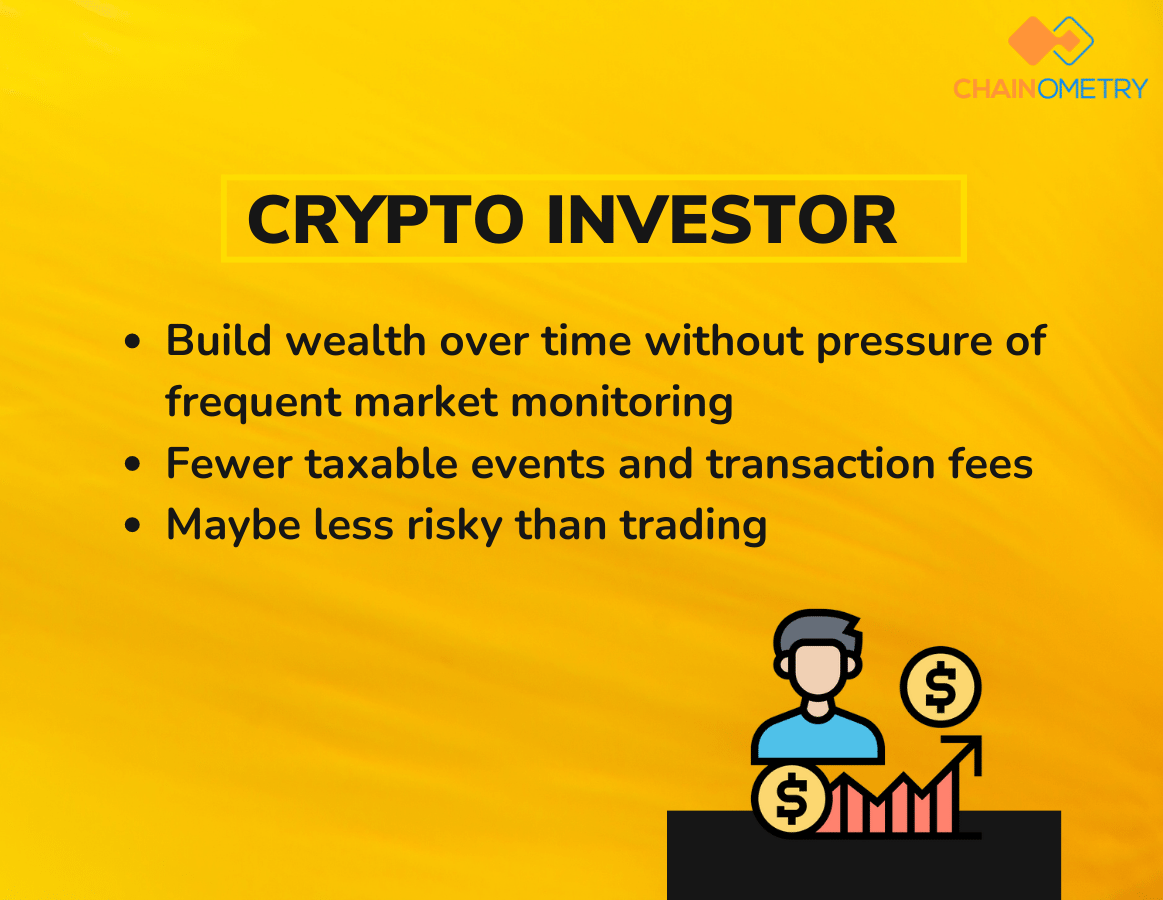

What are the advantages of being a Crypto Investor?

- Build wealth over time without the pressure of frequently monitoring the market.

- It incurs fewer taxable events and transaction fees.

- Maybe less risky than trading

Potential drawbacks of crypto investing:

- It can take a longer time to get a return, especially during bear markets.

- It takes time and effort to truly comprehend a coin’s background.

Assessing the intrinsic value of a crypto project does not come easy as the traditional fundamental analysis methods like

price–earnings ratio

don't usually apply. Arguably, assessing Crypto projects relies on the past success of the team members behind the project. For example, the

Cardano (ADA Coin) founder, Charles Hoskinson was one of the founders of the second

largest cryptocurrency project Ethereum. Fun fact, Charles gave away all his Ethereum (now worth hundreds of milliions of US dollars)

to his Secretary. Talk about being in the right place at the right time.

Crypto Trading

Trading is a short-term approach that leverages the short-term volatility of crypto asset price for profit. While investing has a time frame of months and years, trading ranges from minutes to days.

Trading in crypto can be very profitable due to the high market volatility – of course when it's done with the right timing.

Unlike crypto investors, crypto traders need to be continuously updated with day-to-day market sentiment and also be aware of sudden spikes and slumps. They're likely to seek speculative opinions and be quickly informed on news so they can gauge how these will impact the spot price of a token.

Further, experienced traders would depend upon technical analysis indicators (e.g. MACD, Relative Strength Index) & cryptocurrency social media indicators (e.g. the fear and greed index, Crypto FOMO indicators, etc) to help them predict changes in price patterns.

What are the advantages of Crypto Trading?

- Can potentially make a huge profit in a short time.

- Can start with a small capital and magnify profit by focusing on active market monitoring.

- May benefit from ‘High risk, high return’.

Potential drawbacks of being a crypto trader:

- It involves more taxable events and transaction fees due to active selling and buying.

- Too much risk exposure.

- Much higher complexity when determining tax position and compliance.

The best traders employ a simple trading strategy that has been back tested with enough history and stick to it. Consistency is the key here,

pro traders don't change their strategy becuase it's not working in the short term because they know that strategies are best deployed over the long term.

FINAL THOUGHTS

Crypto trading is a thrilling quick way to make money as the crypto market is highly volatile. However, with a great return comes great risk — you can also experience sudden BIG LOSS. If you prefer to chill out and avoid exposure to volatility, you can stay with the option of long-term crypto investing.

Oh wait, there’s actually another thing to consider: the difference between the two in terms of tax. Are crypto traders & investors treated equally by the tax standard?

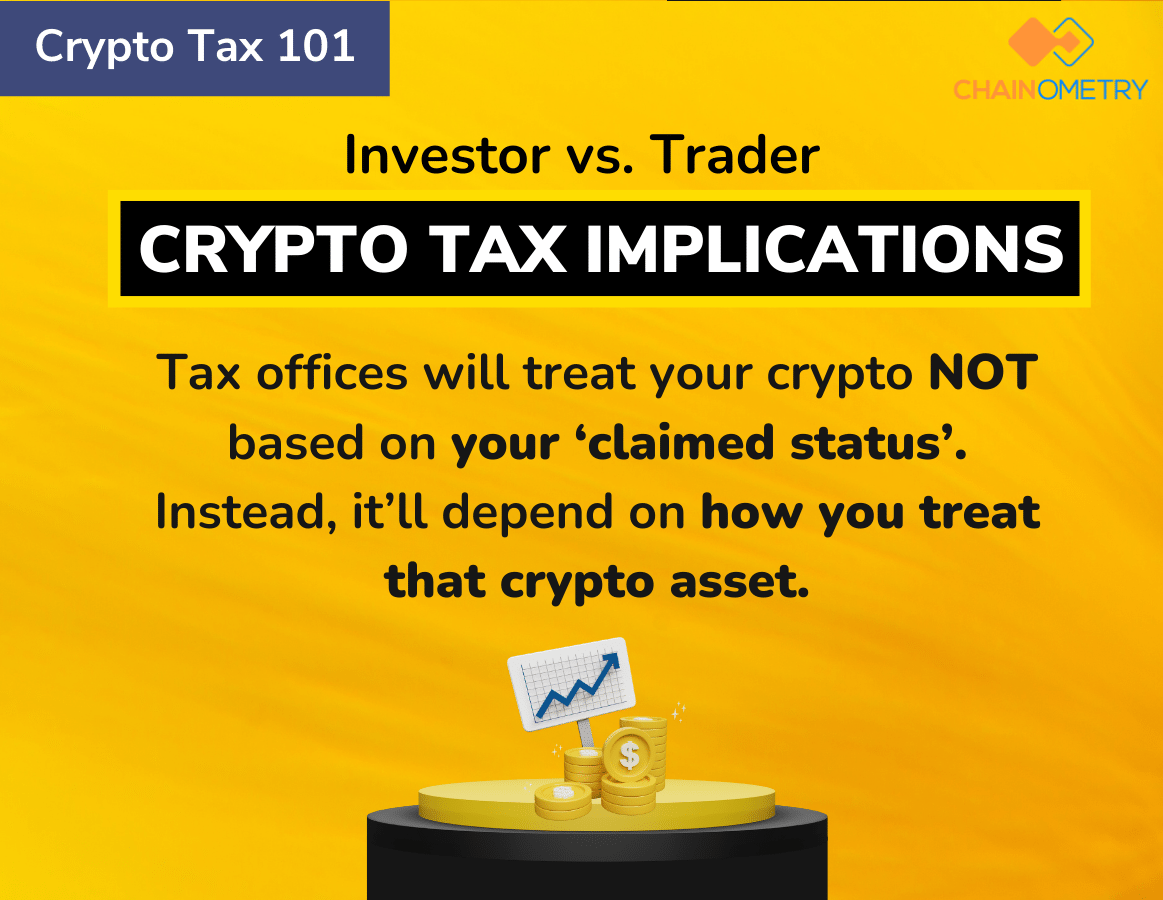

CRYPTO INVESTING vs. TRADING: DIFFERENCE IN TAX IMPLICATIONS

Generally, how crypto investing and trading are taxed would follow a similar concept: when there’s a gain in the disposal of a cryptocurrency asset, it’d be subjected to a form of tax — usually Capital Gain Tax (CGT) or Income Tax — depending on a particular country’s tax regulation.

When CGT is the rule, capital loss resulting from a crypto asset disposal can offset the capital gains in current or future years.

It’s always best to always have check on your country’s cryptocurrency tax regulations. If we take ATO (Australian Tax Office) crypto tax regulation as an example, crypto investing can get may get a CGT concessional discount of up to 50% depending upon the investor's legal status (individual, partnership, or trust) and up to 10% for Self-Managed Super Funds, if the investment is held for more than 12 months.

Furthermore, some “crypto tax-free” countries that appear to be not taxing crypto transactions, actually do impose a tax on experienced ‘day traders’ but not on investing beginners.

At the end of the day, tax offices will treat your crypto NOT based on your ‘claimed status’. Instead, it’ll depend on how you trade:

- Even if you’re carrying out a bona fide ‘crypto trading’ business, if you’ve been treating crypto as a long-term investment (e.g. no trading, no day-to-day persistent records of market monitoring), then that crypto should be taxed as an investment asset when sold..

- The other way around, a capital investor who trades crypto with a definite profit motive daily should be taxed as a trader in relation to that particular crypto, but as an investor to all other crypto investments.

CHAINOMETRY Simplifies your Crypto Trading and Investing

CHAINOMETRY provides crypto tax solution and a handy analytical tool for all — whether you’re a crypto investor with few transactions or a day trader with thousands.

We generate the most accurate and reliable accounting reports with various cost-basis methods to choose from based on your country’s preference – of course, at the best price.

We also help you make better trading decisions with dependable & easy-to-use analytic tools powered by real-time data processing – all included for free. These features will help you make better decisions – in your investing and trading activities.

- Chart showing realized profit and loss over time.

- Success metric on trading performance.

- Monitoring and comparing asset value against top assets.

- Keep track of personal balance across various exchanges and wallets.

- Understanding trading performance across different trading accounts & different financial years.