How does Chainometry compare with other tax calculators?

Using CoinTracking.Info to Generate Cryptocurrency Tax Reports

Other Observations when Comparing CoinTracking.Info to CHAINOMETRY

Fees are correctly included in both tax calculators however CoinTracking does not support automatically importing fees that are different from the asset or currency of the transaction (called third party fees by CoinTracking.Info). Binance, for example, often uses BNB to pay for fees which are often not part of the sale or buy transaction. CHAINOMETRY shows these fees listed them their own section with all the other fees and a grand total. In order to import these fees in CoinTracking you need to follow the following instructsion (from the CoinTracking.Info help page on fees):

Any fee that is paid in a third currency (i.e. a coin that is not part of either the sell or the buy) is not deducted from the total balance.

A common example is BNB on Binance.

In order to correct your third coin balance in the portfolio, you need to create an additional transaction as [OUT] Lost for the fee.

Contacting CoinTracking.Info

I was able to get support from CoinTracking.Info about Tax Report Issue #1 (BTC deposit was not used as a source of fund to calculate cost basis for release (sale) of BTC), they have advised that deposits cannot be used as a cost basis and suggested that I add initial source of funds as trades. In order to add a trade it is mandatory on the CoinTracking.Info interface to add both the buy and sale transaction. This would mean that I would have two sale transaction unless I adjust the original sale record.

Using CoinTracking.Info to Generate Cryptocurrency Tax Reports

Entering Binance Transactions into CoinTracking.Info

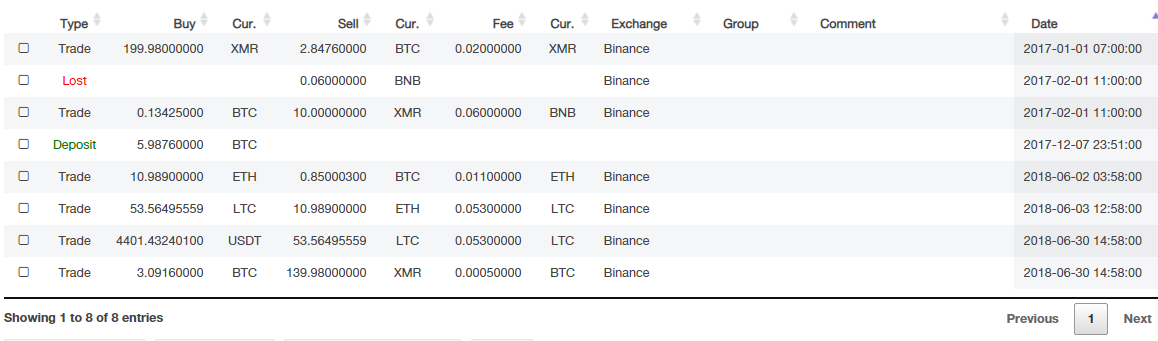

The above trades were added to the CoinTracking.Info web site using the Binance Exchange.

Unfortunately, it would not allow me to upload my deposit file so the deposit transaction was added manually.

Here's what the data looked like after adding all the transactions (3 trades and 1 deposit):

For some reason the times on the dates were changed during import of the csv file. Most likely due to some time zone manipulation. They were off by between 1 and 2 hours from the UTC time exported from the exchange. Two hours can mean large price differences in the crypto world so this may lead to some incorrect cost-base valuations.

BNB Fee is handled as a lost coin rather than a trading expense (see line 2 of CoinTracking.Info transactions above). CoinTracking.Info uses this method when the fee is taken out of a currency not related to the transaction. More information about that below.

The next part will be to create a tax report and see whether it was able to handle the challenges noted above so that you pay the correct amount of tax on your crypto transactions.

Tax Reports Generated on CoinTracking.Info

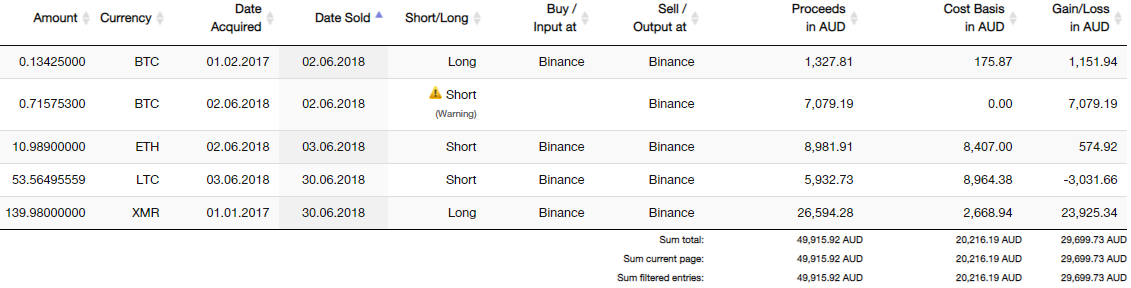

The following tax report was generated on CoinTracking.Info using the menu option Tax Report > Tax Report

Tax Report Issue #1

On the second transaction of the crypt tax report, BTC is listed as a sale (short term) but you'll notice a warning near the word 'Short'. The warning is: 'There is no suitable purchase to this sale. Assuming purchase on the same day for 0 AUD. CoinTracking did not use the deposit of BTC as a source of funds for the sale of BTC, the result of this is a cost base of 0.This means that the entire sale will be viewed as profit as CoinTracking thinks you received BTC for free. In reality, you paid a hefty price for bitcoin ($14,400 USD) and the tax report should show a loss of $-7,373 not a profit of $7,079. The good thing here is that at least you were alerted to this issue with the warning icon but checking hundreds of records hovering over the warning indicator for a description can get tedious.

Tax Report Issue #2

The financial period needs to be configured for each tax report when the tax period is not from 1st of Jan to 31st December. If this differs from your region you are required to set the dates manually before creating each year's tax report. This is not just a issue of convenience. Separating transactions into the correct tax periods is a way to account for opening and closing stock balances. It also important for 'sealing' or publishing a tax period so that settings like stock valuation method (e.g. FIFO) and balance valuation method (e.g. value at Cost) are saved for the period. That way, when you generate future reports, this data is used to initialise your current tax period with the correct opening balances.Closed Position Report on CoinTracking.Info

Your closed positions are an important part of your tax preparation. Missing or wrong data here can misrepresent the amount of tax you need to pay for your crypto.

The closing position report correctly shows the closing balance for held assets and also shows the amount at cost and the value at period for the asset.

Tax Report Issue #3

The closing report doesn't include the correct BTC balance.

The BTC Balance of 3.0916 is the result of the sale of XMR however the closing report on CoinTracking.Info is missing additional BTC due to the deposit entry on the 7th December 2017. The closing report should include an additional 5 BTC.

Tax Report Issue #4

Opening Balances are not shown on the tax report. Any stock balances held over from previous financial periods should be shown on the current year's tax report. 200 XMR was purchased in he previous period and has a carry over quantity of 189.98 with a balance of $3,614 AUD. This is omitted on the CoinTracking.Info tax reports.

Tax Report Issue #5

Previous period losses are not carried forward to the current period. A loss was made on the sale of XMR for the previous tax period. This amount was not included in the CoinTracking.Info tax report or detailed tax report.

Other Observations about CoinTracking.Info

This issue is more an issue of convenience. It would be convenient to show a summary of all purchases, sales, opening stock and closing stock on one simple page. Accounting software often provides this convenient report to summarise stock and profit/loss positions in a simple view. In CoinTracking.Info you can view the detailed tax report which has a summary of short term and long term losses & profit but the other sections require you to print a separate pdf for each section: Sales, Income, Gift and Donations, Lost and Stolen and Closed Positions.

Using CHAINOMETRY as a Tax Calculator

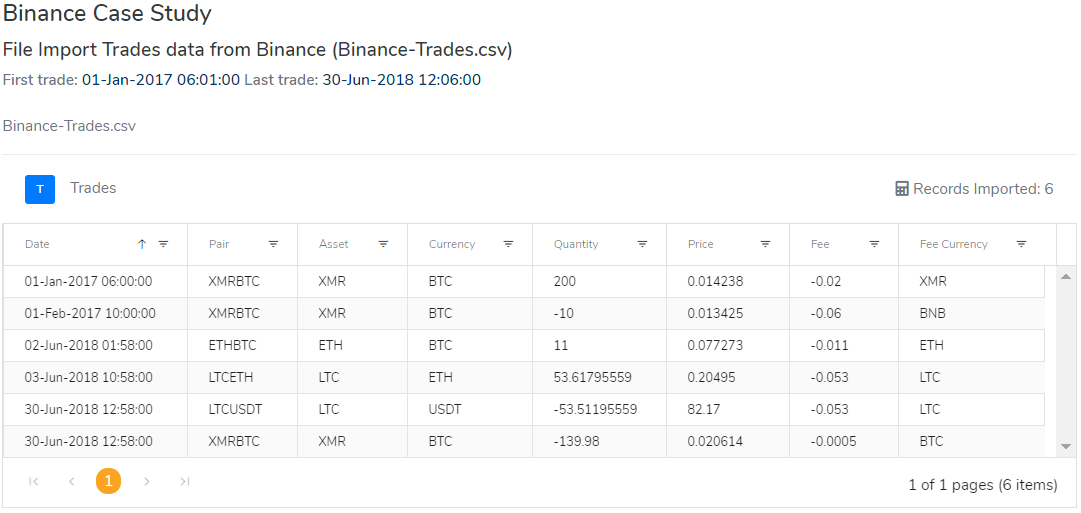

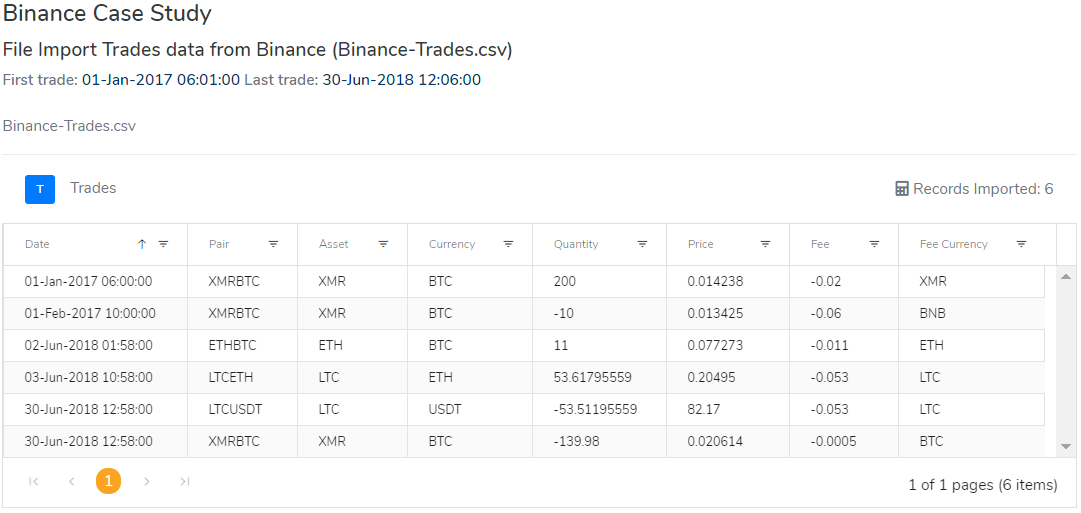

Entering Binance Transactions into CHAINOMETRY

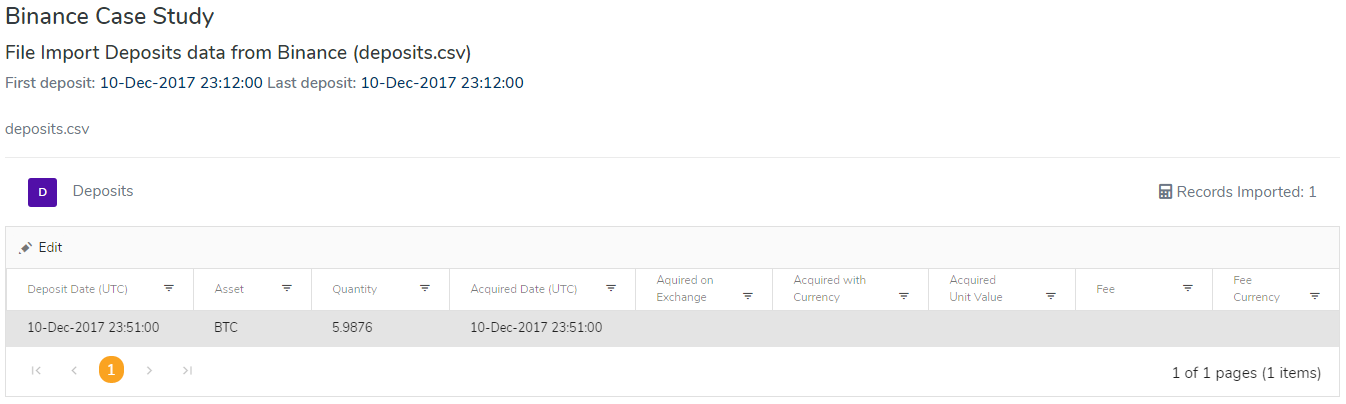

Both the trade file and deposit file were uploaded without issue.

Purchase trades a indicated with a positive (+) quantity value and sell trades are indicated with a negative (-) quantity value. Also notice that the asset pairs were correctly separated and the grid shows which column is the asset and which column is the currency. When currencies can be both assets and currencies (depending on the context), this is helpful.

Deposit import allows you to override the acquired date so that if the deposit was acquired on a different date than the deposit date, the acquired date will override the deposit date. This is helpful when you received and paid for the asset before depositing it into the exchange. This will lead to a different valuation of the asset deposited.

Tax Reports Generated on CHAINOMETRY

There's two main tax reports available on the CHAINOMETRY tax calculator. The capital gains report for investors and the trading report for traders. These tax reports have all sections in one convenient PDF file so there's no need to print mutiple PDF's for each section. Let's look at both reports and the output.

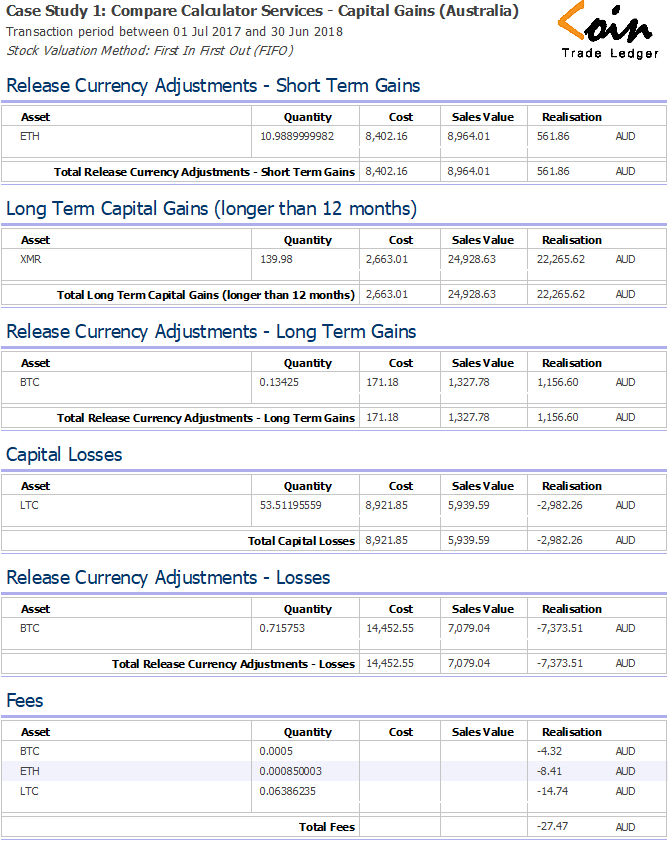

The first page of the PDF report shows data broken down into different categories; losses, gains, fees and release currency adjustments.

In order to address Tax Report Issue #2, CHAINOMETRY uses financial periods that relate to the user's selection of their tax region. The user is therefore able to use the tax region specific to their reporting location which includes things like financial period dates, capital gains tax percentages and other settings. In my case I reside in Australia and therefore use the Australian tax region which has the financial period between July and June, short term capital gains period of 12 months or less, a short-term capital gains rate of 45.8% and long term capital gains rate of 22.5% at the time of writing.

CHAINOMETRY also allows you to publish or finalise your report for the tax period which will save settings like stock valuation method (e.g. FIFO) and balance valuation method (e.g. value at Cost). This will correctly initialise the opening balance for your next year's tax report.

Release currency adjustments are records that show profits or losses as a result of using a coin type currency to buy another coin (the acquired coin is known as the asset). In our report we have adjustment records for BTC and ETH because BTC was used to buy ETH and ETH was used to buy LTC. When you use a coin to buy a coin (rather than a fiat currency like USD) you are essentially 'releasing' or selling the coin that is used as a currency. This means you have a sell transaction as well as a buy transaction recorded in the ledger each time you buy a coin with another coin. You can find more about release currency adjustments here.

Comparing Cointracking.Info to CHAINOMETRY the realisations of ETH, BTC and LTC roughly coincide with eachother. Both tax calculators are able to record these releases of currency when using a coin to buy another coin. This is an important aspect of any tax calculator and you should always check that this feature is available. Both tax calculators also correctly show the XMR sale and the release of BTC as a long term reallisation as the asset was held over 12 months. This allows you to claim capital gains tax discount if you country supports it.

Addressing Tax Report Issue #1, CHAINOMETRY shows an additional release of currency for BTC which is missing on the Cointracking.Info data. BTC was used to buy ETH on the 2nd June 2018 but was acquired on the 7th July 2017. When releasing this currency to buy ETH there was a loss recorded of $-7,373. This was becuase the value of Bitcoin (BTC) dropped by more than half during that period.

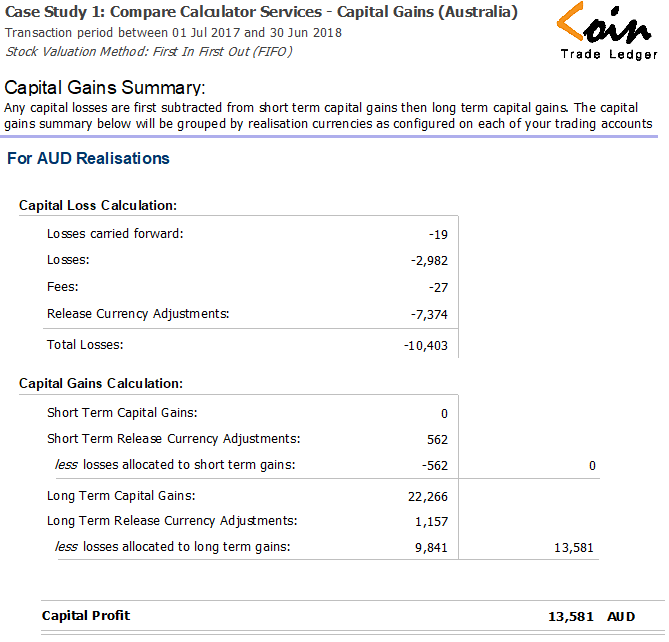

Capital Gains Summary on CHAINOMETRY

On the second page of the capital gains report on CHAINOMETRY tax calculator a summary is shown with all the totals and main tax sections - gains, short term and long term losses. This is convenient for tax reporting and shows the overall profit or loss from you trading during that period. In our summary for the capital gains report you can see an overall capital profit of 13,581 AUD.

Notice also that losses are first allocated to short term capital gains then from long term capital gains thereby maximizing your long term capital gains tax discount. Any losses from the previous tax period will also carry forward to this tax period (Tax Report Issue #5) and is listed on the section 'Losses carried forward'. This will also help reduce your tax burden.

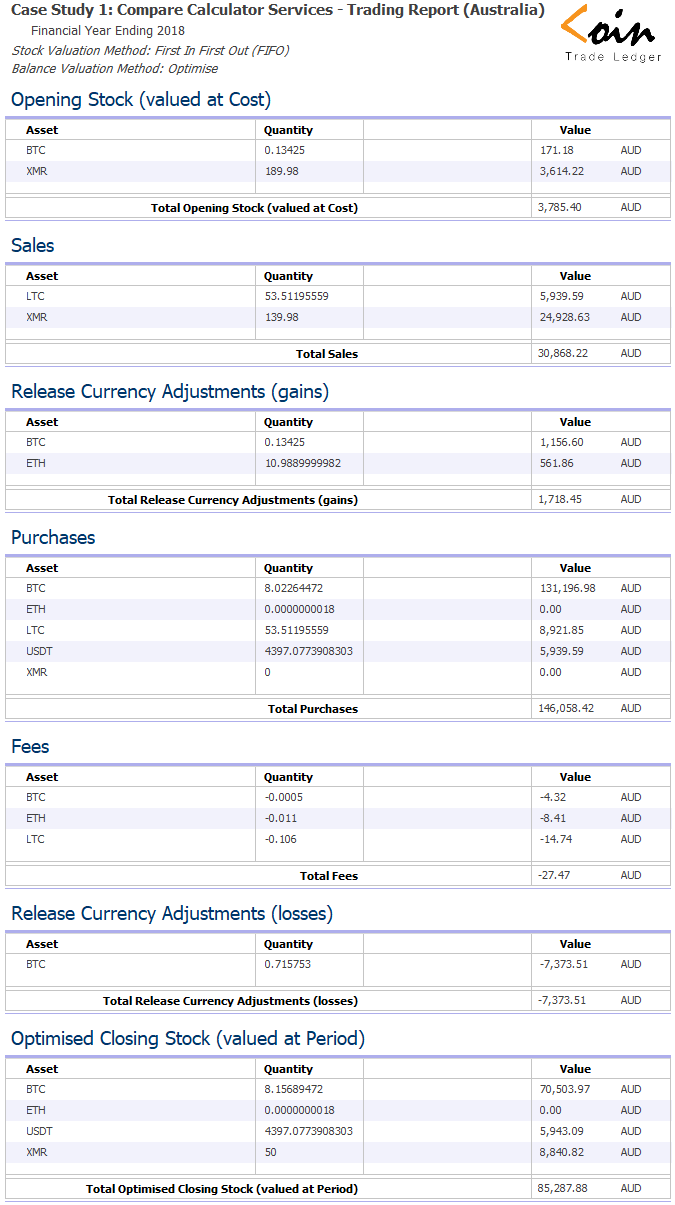

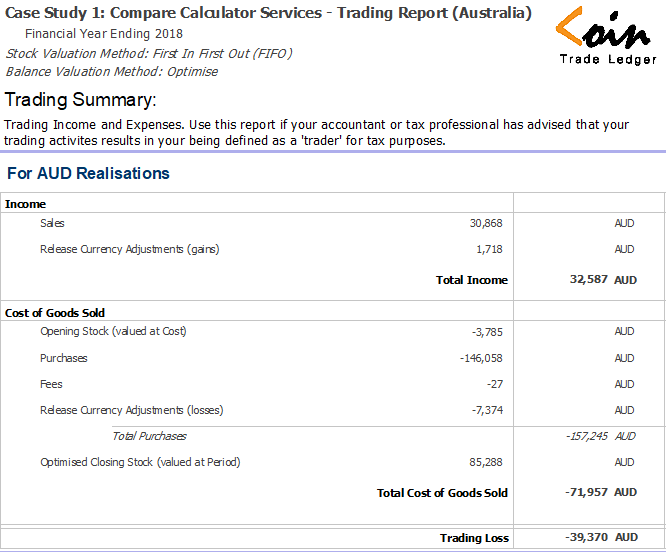

Trading Report on CHAINOMETRY

If you are a trader (and most who trade crypto currency with high volume would be considered one) you can use the specialised trading report on CHAINOMETRY. The trading report adds vital sections to the tax preparation such as opening balance and closing balance with various options for stock valuation.

The closing balance of BTC includes the deposit of BTC on the 10th December 2017. All deposits in CHAINOMETRY are included in calculations for opening and closing stock as well as used as a pool of funds for trades (Tax Report Issue #3)

Notice the opening stock (Tax Report Issue #4) of XMR and BTC which was purchased and deposited in the previous period. You have control on the preferred valuation of both opening and closing stock. You can choose to value at cost (the price you purchased the stock) or at period (the price of the stock at the end of the reporting period). The third valuation option is 'Optimise' which chooses the most favourable valuation for tax minimisation. In this example, opening stock was valued at cost as it was the most optimal tax minimisation strategy. Once you have decided your valuation you can 'publish' your report thereby freezing the valuation for that period.

The closing stock in this example was valued at period. This was also an automatic selection when you select 'optimise' for stock valuations. A lower closing stock valuation means a better tax position leading to an overall trading loss of $-39,370 AUD. If we were to value closing stock at cost that would make the closing stock value at $138,259 AUD leading to a trading profit of $13,601 AUD. This change in stock valuation is the difference between getting a tax refund for the period based on a loss of $-39K or paying tax on a profit of $13K.

The trading report on CHAINOMETRY also has a summary section for easy reporting on your tax preparation documents.

Dealing with Data Issues

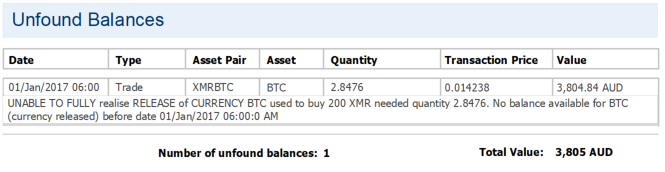

We saw that on Tax Report Issue #1 CoinTracking.Info used the exclamation mark against a record on the tax report. It also lists the number of warnings in red on the header section of the report. CHAINOMETRY uses an alternative method for reporting issues with data. A separate section is available for showing all the issues which is included on the web site as well as the report. Here is what it looks like on the CHAINOMETRY report:

There are many reasons why unfound balances arise. You can get more information about them here. The above error is telling us that XMR was purchased using BTC but there was no BTC balance available before 1st Jan 2017. So, in other words, your trading shows that you purchased something without have sufficient funds to purchase the asset. This is generally not allowed on exchanges so the system brings up the error.

In general something like this points to a missing deposit or sale but there may be legitimate reasons for such a transaction. As an example, where you receive an AirDrop, you will essential received 'free' coin. In this case you will not have a previous purchase or deposit.

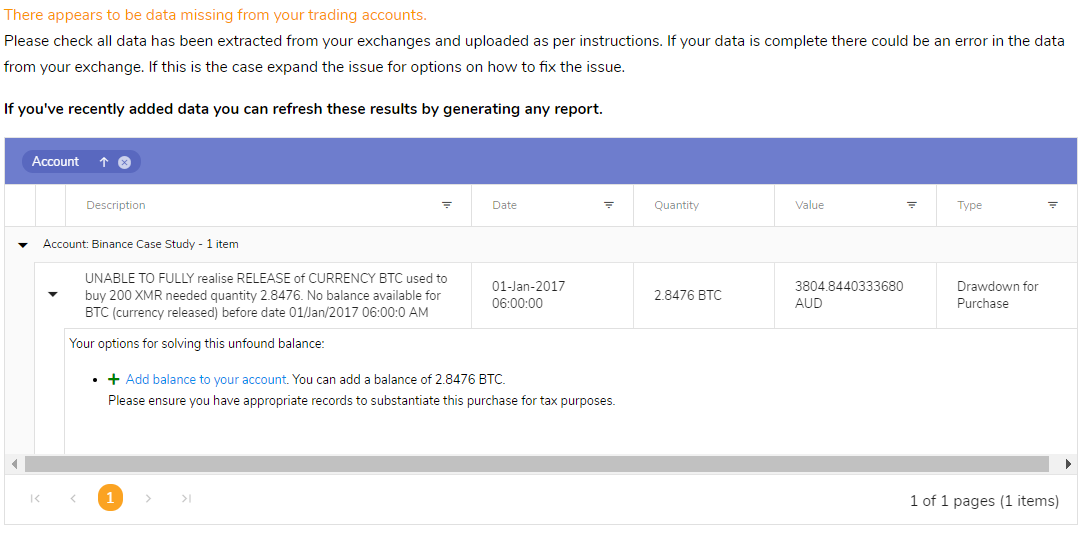

How to fix data errors on CHAINOMETRY

When an unfound balance error is detected you have several options for fixing this error. CHAINOMETRY gives you complete control on how to handle such errors.

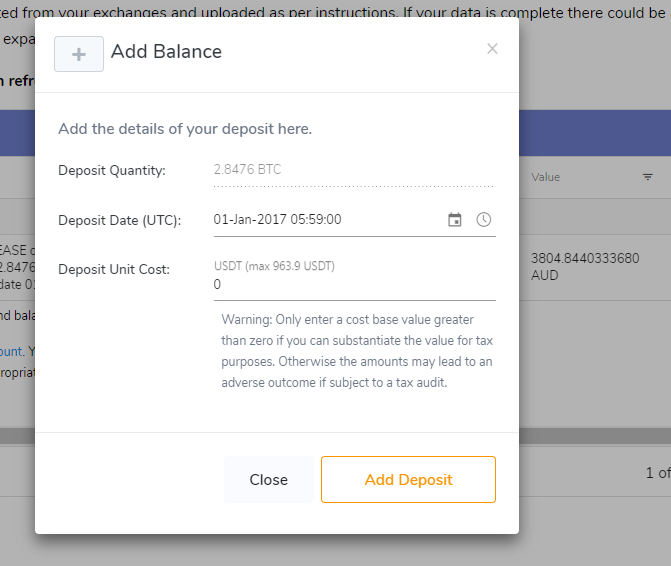

The example above shows the unfound balance on a separate list available on your account. For this particular issued there is one fix available. You can add balance to your account with your desired cost basis. This enables you to support the balance needed using a deposit transaction with a value that you set (or a zero value if fixing an AirDrop). Clicking on the 'Add balance to your account' link shows the following interface:

The example above we see that the system will automatically add a deposit transaction to support the currency needed to fulfill the XMR purchase (notice the date is one second before it is needed). All you need to do is add a unit cost or accept the default value of 0. The unit cost also shows something very handy. The value of USDT at the time of deposit. This value is obtained from the minute-minute archive of price data stored on CHAINOMETRY. You cannot value your deposit more than the going rate at the time of deposit. This prevents you from accidentally overvaluing your asset which would lead to problems if you undergo a tax audit.

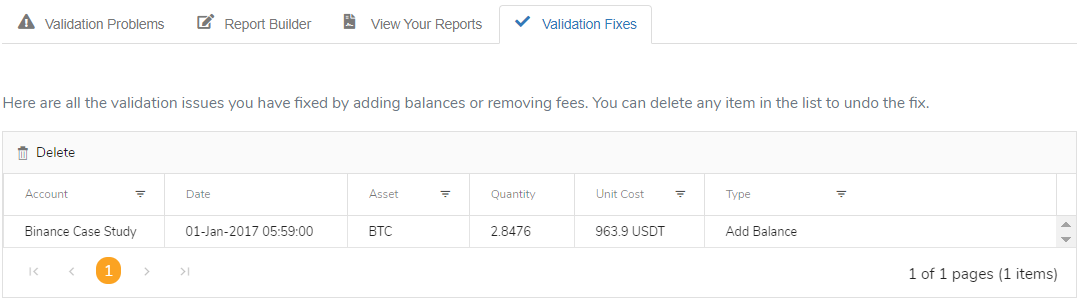

Fixing errors can be undone on CHAINOMETRY

Any fixes that you apply on CHAINOMETRY can be removed at any time without affecting your original data. In fact, your data is never modified at any point during the report building process. To undo your changes find the change in the separate list of changes and delete the item:

Other Observations when Comparing CoinTracking.Info to CHAINOMETRY

Fees are correctly included in both tax calculators however CoinTracking does not support automatically importing fees that are different from the asset or currency of the transaction (called third party fees by CoinTracking.Info). Binance, for example, often uses BNB to pay for fees which are often not part of the sale or buy transaction. CHAINOMETRY shows these fees listed them their own section with all the other fees and a grand total. In order to import these fees in CoinTracking you need to follow the following instructsion (from the CoinTracking.Info help page on fees):

Any fee that is paid in a third currency (i.e. a coin that is not part of either the sell or the buy) is not deducted from the total balance.

A common example is BNB on Binance.

In order to correct your third coin balance in the portfolio, you need to create an additional transaction as [OUT] Lost for the fee.

Contacting CoinTracking.Info

I was able to get support from CoinTracking.Info about Tax Report Issue #1 (BTC deposit was not used as a source of fund to calculate cost basis for release (sale) of BTC), they have advised that deposits cannot be used as a cost basis and suggested that I add initial source of funds as trades. In order to add a trade it is mandatory on the CoinTracking.Info interface to add both the buy and sale transaction. This would mean that I would have two sale transaction unless I adjust the original sale record.